Financial services corporation Visa Inc. (V) announced that it has entered into a definitive agreement to acquire foreign exchange solutions provider Currencycloud for £700 million ($963.3 million).

Following the news release, shares of the company rose marginally in Thursday’s trading session. However, it pared its gains slightly to close at $244.13 in the extended trading session.

With this buyout, Visa is expected to strengthen its foreign exchange capabilities by enhancing its offerings to its customers, which include various financial institutions and fintech companies.

The Global Treasurer of Visa, Colleen Ostrowski, said, “The acquisition of Currencycloud is another example of Visa executing on our network of networks strategy to facilitate global money movement. With our acquisition of Currencycloud, we can support our clients and partners to further reduce the pain points of cross-border payments and develop great user experiences for their customers.” (See Visa stock chart on TipRanks)

Two days ago, Goldman Sachs analyst Matthew O’Neill reiterated a Buy rating on the stock. The analyst, however, raised the price target to $264 from $262, which implies upside potential of 8.1% from current levels.

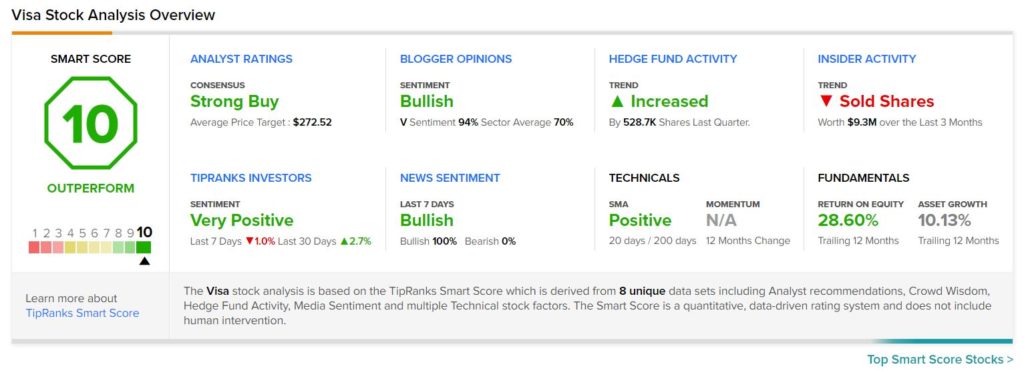

Consensus among analysts is a Strong Buy based on 21 Buys and 2 Holds. The average Visa price target of $272.52 implies upside potential of 11.6% from current levels.

Visa scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 23.7% over the past year.

Related News:

KKR to Snap up Teaching Strategies from Summit Partners

Intel Joins Hands with Airtel; Shares Rise

Salesforce Concludes $27.7B Slack Buyout