Shares in Visa (V) pulled back 2% in Tuesday’s after-hours trading after the financial giant reported disappointing revenue for the fiscal third quarter.

Specifically, revenue of $4.84B represented a 17% year-over-year decline, and missed consensus estimates by $10M. However non-GAAP EPS of $1.06 beat Street forecasts by $0.02, as did GAAP EPS of $1.07 which beat estimates by $0.03.

Meanwhile, overall payment volume of $1.95T beat the analyst estimate of $1.90T.

Through July 21, Visa said that U.S. payment volumes are up in the mid- to high-single digits, with debit outperforming credit. U.S. card not present (ecommerce) volumes are also relatively stable.

Processed transactions have improved to roughly flat in July from down 4% year-over-year in June and 24% in April. Finally, cross- border volumes declined 44% year-over-year for both the month of June and the first three weeks of July.

“Overall volume trends point to stabilization, while cross-border volumes / international fees continue to struggle given the lack of travel” commented RBC Capital analyst Daniel Perlin following the report. “However, contactless & new payment flows point to solid long-term growth” he added.

Looking forward, Perlin believes that FQ4/20 results will have significant noise as service fees are calculated on a one-quarter lag. Management noted that if service fees had been calculated without the lag, FQ3/20 services fees would have declined (11%) y/y and total net revenue growth would have been 4.5ppt lower.

“We believe that the lag and incentive percentage increase will result in FQ4/20 new revenue growth to be worse than FQ3/20’s y/y decline of (17%)” the analyst warned.

Perlin nonetheless reiterated his buy rating on the stock but dropped his price target from $247 to $243. This still suggests significant upside potential from the current share price of $197.

“Our valuation is based on our view that V will be able to expand its constituencies, improve its competitive position, and accelerate secular trends as we emerge into a more normalized phase of growth” he explained.

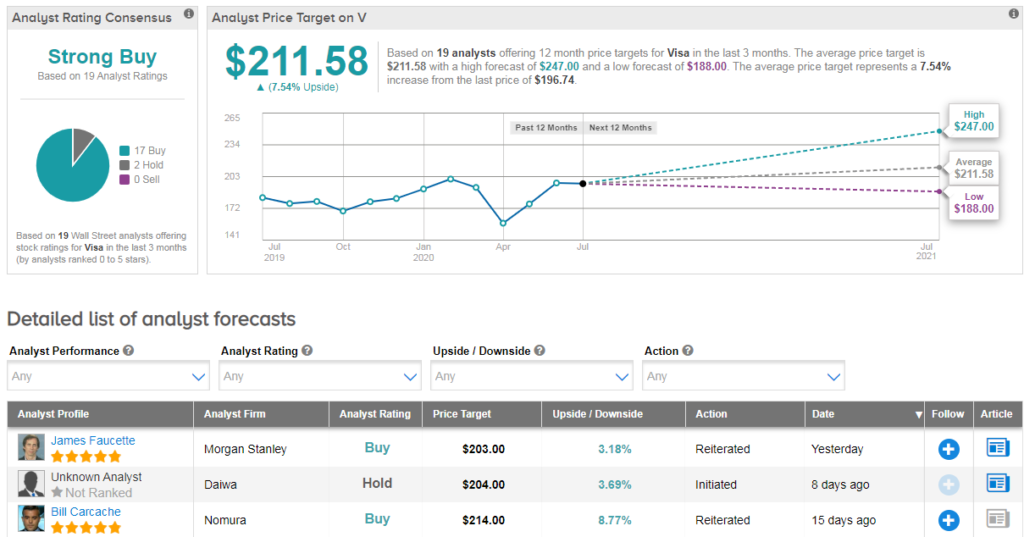

Overall, Visa scores a bullish Strong Buy analyst consensus with an average analyst price target of $212 (8% upside potential). (See V stock analysis on TipRanks).

Related News:

Amazon Shares Rise As Analysts See More Upside

Intel Faces Analysts’ Wrath, Stock Slips Over 16%

Verizon (VZ) Stock Looks Attractive After Earnings, Says 5-Star Analyst