Financial services major Visa (NYSE: V) recently announced that the company has entered into a partnership with a consumer authentication services provider, PopID, to launch facial verification payment acceptance in the Middle East region.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the news, shares of the company declined almost 1% to close at $226.51 in yesterday’s session. The stock continued its slide today.

With biometrics strongly positioned to play a crucial role in digital payments in the next decade and beyond, Visa’s partnership is expected to provide cardholders with new safe, secure, and innovative ways to pay.

Initially, the diversified global investment company, Dubai Holding, will deploy PopPay at some of its prime locations, which will be followed by the adoption of the payment technology across Dubai Holding’s wider ecosystem.

Further, banks issuing Visa cards will receive an invitation to become part of the platform and provide clients the option to link their facial biometrics to their debit or credit cards to make payments. Moreover, acquiring banks will be offered the opportunity to distribute PopID’s proprietary face pay terminals to brick-and-mortar businesses.

Management Commentary

Head of Visa CEMEA Innovation & Design Akshay Chopra said, “Facial biometric payments are at the forefront of payments innovation, providing cardholders a fast, seamless and most importantly, secure way to authenticate and make a payment.

“From across our partner network, we’ve seen heightened interest in co-creating new facial and biometric payments moments. Through this partnership with PopPay, we are keen to help clients roll out biometric payment capabilities faster and with more success.”

Wall Street’s Take

Recently, Barclays analyst Julian Mitchell reiterated a Buy rating on the stock. The analyst, however, lowered the price target from $265 to $260, which implies an upside potential of 18% from current levels.

The consensus among analysts is a Strong Buy based on 16 Buys and three Holds assigned in the past three months. The average Visa price target of $273.18 implies an upside potential of 23.9% from current levels. Shares have gained 0.7% over the past year.

Hedge Funds’ Confidence

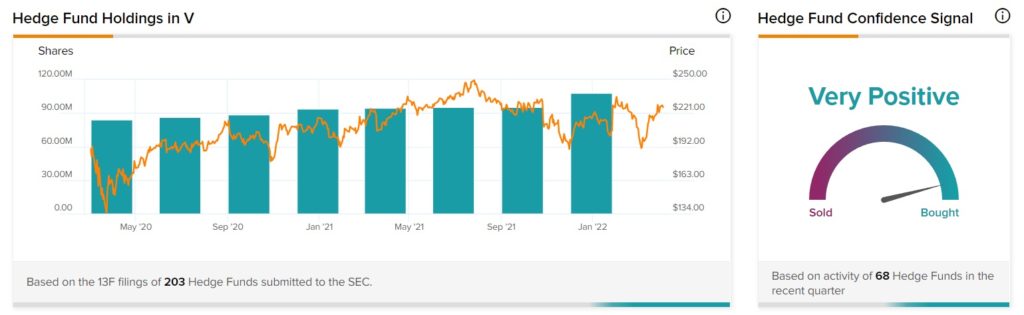

TipRanks’ Hedge Fund Trading Activity tool shows that hedge fund confidence in Visa is currently Very Positive. Moreover, the cumulative change in holdings across the 68 hedge funds that were active in the last quarter was an increase of 12.5 million shares.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Equinix Expands Footprint in Africa

Marathon Digital Dips Despite Positive Bitcoin Production News

Raytheon Technologies Benefits from Russia-Ukraine conflict