In an industry where volatility and volumes have declined, Virtu Financial’s (VIRT) top-and-bottom-line Q2 beats have grabbed attention. The stock is up over 21% since the company announced the most recent quarter’s financial results, and the shares trade at a discount to industry peers, making the company a compelling opportunity for investors looking for exposure to the financial sector.

Virtu Offers Award-Winning Execution Management

Virtu Financial is a financial firm that offers services across the United States and multiple international markets, segmented into Market Making and Execution Services. The company provides various products featuring execution, liquidity sourcing, analytics, and broker-neutral capital markets. This diverse portfolio enables clients to trade on different venues in over 50 countries and deal with asset classes such as global equities, ETFs, options, foreign exchange, futures, fixed income, cryptocurrencies, and a wide range of commodities.

The company’s multi-asset execution management system, Triton Valor EMS, facilitates trading equities, ETFs, futures, options, FX, and fixed income across more than 700 brokers and venues. It caters to all types of flow and was designed specifically to aid traders in reaching their goals throughout the trade lifecycle. The platform was recognized as the best Equity E/OMS at the Market Media’s European Markets Choice Awards 2024.

Analysis of Virtu’s Recent Financial Results

Virtu’s financial results for the second quarter of 2024 outperformed analysts’ estimates on multiple fronts. Revenues reached $385.08 million, beating analysts’ expectations of $331.57 million while increasing by 36.7% compared to the same period in 2023. Net income experienced a substantial rise by achieving $128.1 million, an exponential increase from the $29.5 million in the prior year quarter. Basic and diluted earnings per share reached $0.71, a significant rise from the $0.16 reported for Q2 2023. Adjusted EBITDA rose by 78.3% to $217.5 million, and earnings per share (EPS) of $0.83, significantly surpassing the expected $0.60.

The company refinanced its existing debt by issuing senior secured loans and notes amounting to $1.7 billion. Moreover, as part of its Share Repurchase Program, the firm bought back $31.0 million worth of its shares (1.4 million shares). Lastly, the Board of Directors declared a quarterly cash dividend of $0.24 per share, scheduled for payment on September 15, 2024, to shareholders on record as of September 1, 2024.

What Is the Price Target for VIRT Stock?

The stock has demonstrated low volatility, sporting a beta of 0.71, while enjoying an upward trend, climbing 65% over the past year. Shares trade at the high end of the 52-week price range of $15.63 – $25.68 and show positive price momentum by trading above the 20-day (22.62) and 50-day (22.36) moving averages. With a P/S ratio of 1.068x, the shares trade at a relative discount to peers in the Capital Markets industry, where the average P/S ratio is 2.67x.

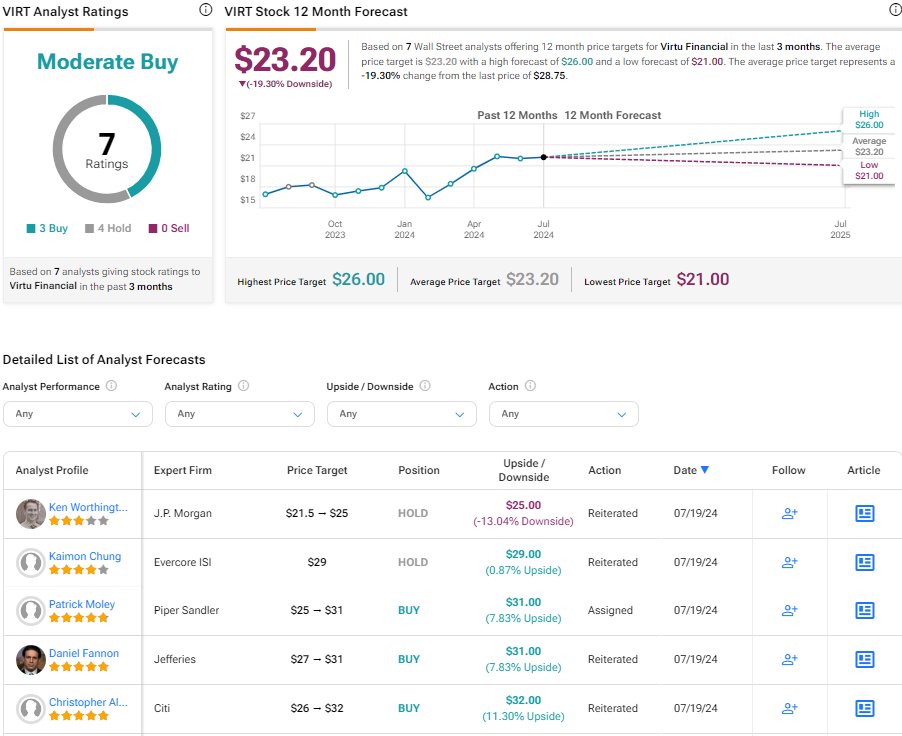

Analysts following the company have been cautiously optimistic about the stock. For instance, Piper Sandler analyst Patrick Moley raised the price target on the shares from $25 to $31 while maintaining an Overweight rating after the Q2 report. He noted that despite a softening in the market-making environment, Virtu surprised with its increased revenues from Q1 to Q2.

Virtu Financial is rated a Moderate Buy based on seven analysts’ cumulative recommendations and price targets. The average price target for VIRT stock is $23.20, representing a potential downside of -19.30% from current levels.

Final Thoughts on Virtu

Virtu’s impressive second-quarter financial results are drawing the eyes of the investment world. With a diverse portfolio, a multi-asset analytics platform, and an award-winning execution management system, Virtu offers substantial growth potential while trading at a discount to industry peers. The company presents a compelling opportunity for investors seeking exposure to the capital markets industry with robust performance and a prospective growth trajectory.