Mid-cap value mutual funds focus on stocks with low valuations and high dividend yields to generate consistent returns. Thus, investors with a value-oriented approach and a long-term investment horizon may consider – VIMAX and FSMDX. Currently, analysts project more than 10% upside potential in these two mutual funds over the next twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s delve deeper.

Vanguard Mid-Cap Index Fund Admiral Shares (VIMAX)

The VIMAX fund invests in a diverse portfolio of mid-sized U.S. companies. It aims to track the performance of the CRSP U.S. Mid Cap Index and provide investors with long-term growth potential. Importantly, it has a low expense ratio of 0.05%. As of today’s date, VIMAX has 333 holdings with total assets of $155.93 billion. Moreover, the fund has generated returns of 15.2% over the past six months.

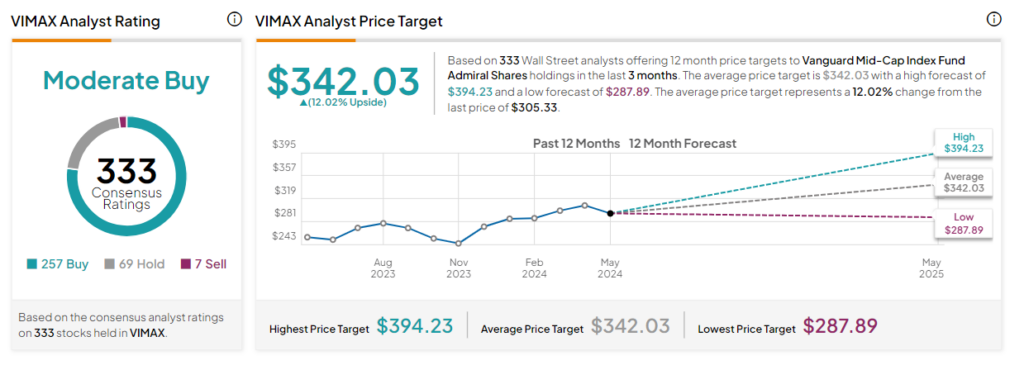

On TipRanks, VIMAX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the total stocks held, 257 have Buys, 69 have a Hold rating, and seven have a Sell rating. The analysts’ average price target on VIMAX of $342.03 implies 12.02% upside potential from the current levels.

Fidelity Mid Cap Index Fund (FSMDX)

The FSMDX fund is managed by Fidelity Investments and invests in a diverse portfolio of mid-cap stocks. It seeks to track the performance of the Russell Midcap Index. The fund has an expense ratio of 0.03%. As of today’s date, FSMDX has 815 holdings with total assets of $31.64 billion. FSMDX has gained 14.6% over the past six months.

On TipRanks, FSMDX has a Moderate Buy consensus rating. This is based on 587 stocks with a Buy rating, 202 stocks with a Hold rating, and 26 stocks with a Sell rating. The analysts’ average price target on FSMDX of $35.95 implies a 12.79% upside potential from the current levels.

Concluding Thoughts

Investors seeking long-term growth potential and lower risk compared to investing in individual stocks could consider mid-cap mutual funds. With a very low expense ratio and a focus on index tracking, both VIMAX and FSMDX offer a cost-effective and efficient way to gain exposure to mid-cap companies.