Shares of Village Farms International (VFF) plunged 20% Monday morning after the greenhouse operator reported a loss in the first quarter, the first full quarter of Village Farms wholly owning Pure Sunfarms.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Village Farms’ revenue came in at $52.4 million for the quarter ended March 31, an increase of 63% from $32.1 million in the prior-year quarter.

Consolidated revenue of $52.4 million includes cannabis sales of $17.4 million from Pure Sunfarms, $34.9 million from produce sales, and $0.1 million of clean energy sales.

Meanwhile, the company reported a net loss of $7.4 million ($-0.10 per share) in 1Q 2021, compared to a net income of $4.2 million ($0.08 per share) in 1Q 2020.

The bottom line was impacted by lower pricing. Indeed, the tomato industry is experiencing one of the lowest price environments for tomatoes-on-the-vine and beefsteak varieties in the past ten years.

Village Farms’ CEO Michael DeGiglio said, “As we look ahead, our 1.1 million square foot Delta 3 facility is operating at full capacity, and with expected strong growth demand we look forward to significantly expanding our production capacity in the coming months, with plans to increase capacity by 50% by year-end and double it in the second half of 2022. All of this positions Pure Sunfarms – with our existing assets and operations – to meaningfully and sustainably grow its profitability over both the short- and long-terms.” (See Village Farms International stock analysis on TipRanks.)

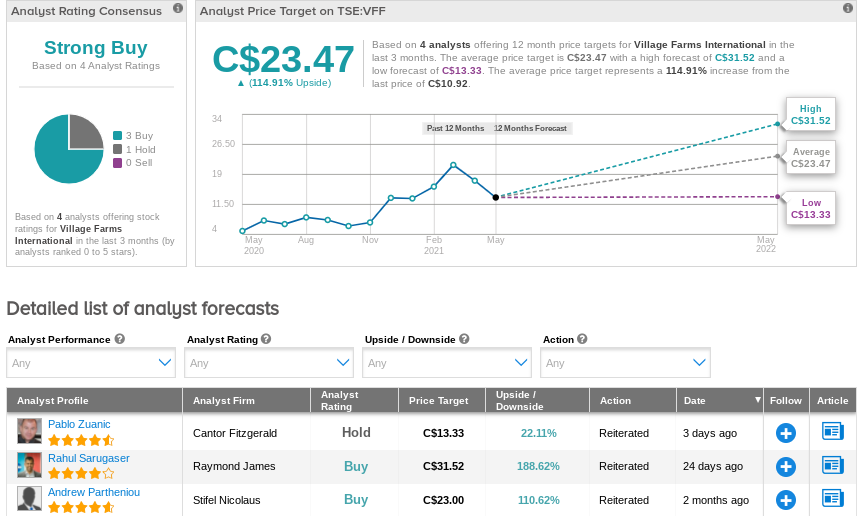

Last week, Cantor Fitzgerald analyst Pablo Zuanic maintained a Hold rating on VFF but lowered its price target to $11.00 (C$13.33) for a 22% upside potential.

Overall, the consensus on the Street is that VFF is a Strong Buy based on 3 Buys and 1 Hold. The average analyst price target of C$23.47 implies a 114.5% upside potential from current levels. Shares have fallen by more than 30% in the last month.

Related News:

Trulieve To Acquire Harvest Health For C$2.1B; Creates Largest U.S. Cannabis Operator

Cronos Group 1Q Profit And Revenue Miss Estimates; Shares Up 4%

High Tide Buys 80% Stake in U.S. CBD Company FABCBD