Shares of ViewRay dropped 13% in Tuesday’s pre-market session after the company announced the pricing of a public offering of 10.31 million shares of common stock at a price of $4.85 per share, to raise gross proceeds of $50 million. Shares of the radiation therapy system manufacturer closed 67.8% higher at the close on Monday after releasing preliminary Q4 and full-year results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

As part of the offering, ViewRay (VRAY) has given the underwriters a 30-day option to purchase up to another 1,546,500 shares of common stock at the public offering price, less underwriting discounts and commissions.

The company plans to use the offering proceeds for general corporate purposes, including working capital, capital expenditures, continued research and development and commercial expenses.

The offering is expected to close by Jan. 7, 2021, subject usual closing conditions. Piper Sandler & Co. is the sole book-running manager for the offering with B. Riley Securities, and Oppenheimer & Co. as the co-managers.

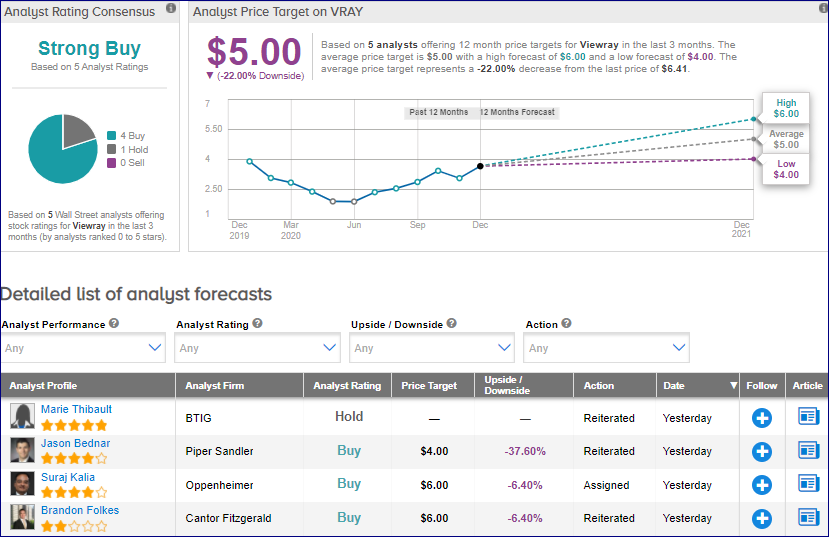

Following the company’s release of preliminary financial results, Piper Sandler analyst Jason Bednar reiterated a Buy rating on the stock and a price target of $4 (37.6% downside potential).

According to Bednar, the company’s Q4 sales rose by 6% year-on-year to $18 million exceeding the Street consensus by $7.2 million. The company received 5 new orders worth $24 million surpassing the Street’s estimates by $5 million.

Bednar was “impressed” with the execution of management through the COVID-19 pandemic, with healthy system installs and new orders despite the more challenging environment for big-ticket hospital capex items.

Bednar continues to believe that the company can grow its MRgRT [Magnetic resonance guided radiotherapy] uptake and utilization that may begin to inflect higher on the other side of the pandemic.

Therefore, Bednar remains “positively inclined” on the stock. (See VRAY stock aanalysis on TipRanks)

From the rest of the Street, the stock scores an analyst consensus of a Strong Buy based on 4 Buys and 1 Hold. The average analyst price target of $5 implies downside potential of 22% to current levels.

Related News:

Activist Investor Carl Icahn Trims Herbalife Stake In $600M Deal

W. R. Berkley To Book $105M Gain From Property Sale; Street Sees 8% Upside

T-Mobile Hit By Second Security Breach In 2020