Red Ventures on Monday announced a deal to buy digital media company CNET Media Group from ViacomCBS for $500 million.

Red Ventures said the acquisition of CNET Media from ViacomCBS (VIAC) accelerates its entry into new business areas, including consumer tech and gaming. The transaction, which is expected to close in the fourth quarter of this year, is subject to regulatory approvals and customary closing conditions.

“Red Ventures believes in the power of premium content from trusted brands that help people make better life decisions,” said Red Ventures CEO Ric Elias. “Over the last 25 years CNET Media Group has built a dynamic portfolio of brands with well-earned authority on such topics as consumer tech and gaming that play an increasingly important role in people’s lives. Red Ventures is eager to invest in CNET Media Group’s growth with more personalized consumer experiences that will reinvigorate CNET Media’s brands and unlock unprecedented opportunity for all.”

CNET Media has a portfolio of digital media brands that advise consumers across leading consumer tech, business tech, gaming, and entertainment media brands including ZDNet, a B2B focused content provider and Gamespot, a US games information brand. The portfolio also includes entertainment and lifestyle brands such as TVGuide, Metacritic and Chowhound.

Founded in 2000 as a marketing startup, Red Ventures has since grown to include more than 100 digital brands with more than 3,000 employees across 10 US cities, the UK and Brazil. Red Ventures’ existing brands operate in the Home Services, Health, Finance, Travel, Education, and Entertainment verticals.

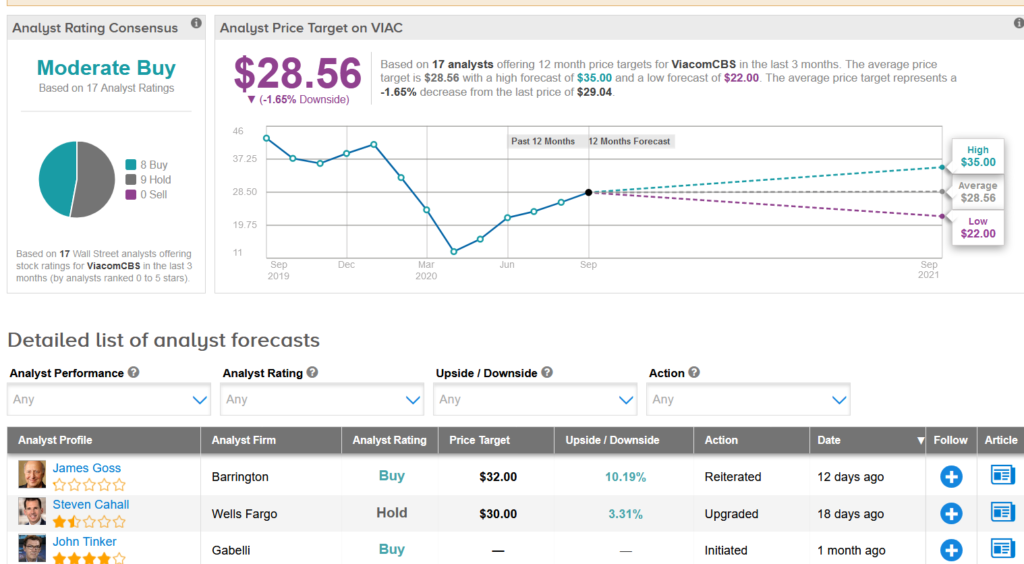

Wells Fargo analyst Steven Cahall last month upgraded VIAC to Hold from Sell and ramped up the stock’s price target to $30 from $19, citing the entertainment company’s video streaming potential. (See ViacomCBS stock analysis on TipRanks)

Cahall believes there is a “key opportunity” if ViacomCBS creates new direct-to-consumer bundles, which “reduces churn and could allow VIAC to be more aggressive on the initial price,” which in turn could serve as a catalyst for subscription growth.

The analyst noted that the company should “cease licensing marquee Paramount and Showtime content to competitors and stop feeding services like Netflix with originals.”

Earlier this month, Barrington analyst James Goss raised his price target to $32 from $30 and reiterated a Buy rating, “after observing a number of developing opportunities including a blended and revised CBS All Access that will include some programming from Viacom”.

Overall, Wall Street analysts are cautiously optimistic on the stock with a Moderate Buy consensus. With shares down 31% so far this year, the $28.56 average price target indicates downside potential of another 1.7%.

Related News:

Scientific Games Pops 15% After Caledonia, Investors Snap Up 34.9% Stake

Buffett’s Berkshire Divests Shares In Liberty Global, Axalta Coating

Buffett’s Berkshire Cuts Stake In Wells Fargo As Analyst Flips To Buy