Vanguard is one of the largest asset management firms that offers a wide range of exchange-traded funds (ETFs). These ETFs are known for low expense ratios and offer investors with wide market exposure and diversification. Today, we have focused on three such ETFs – Vanguard Information Technology ETF (VGT), Vanguard S&P 500 Growth ETF (VOOG), and Vanguard Health Care ETF (VHT) – with more than 15% upside potential projected by analysts over the next twelve months.

Let’s take a closer look at these three ETFs.

Vanguard Information Technology ETF

The VGT ETF provides investors exposure to technology stocks, including companies in software, semiconductors, internet, and other technology-related sectors. This ETF tracks the MSCI U.S. Investable Market Index/Information Technology 25/50 Index.

VGT has $79.64 billion in assets under management (AUM), with the top 10 holdings contributing 58.08% of the portfolio. Importantly, it has a low expense ratio of 0.1%. The VGT ETF has returned 23.4% in the past six months.

Overall, the VGT ETF has a Moderate Buy consensus rating. Of the 318 stocks held, 235 have Buys, 80 have a Hold rating, and three have a Sell rating. At $686.48, the average VGT ETF price target implies a 17.89% upside potential.

Vanguard Health Care ETF

The VHT ETF seeks to track the performance of the MSCI U.S. Investable Market Index (IMI)/Health Care 25/50. This index is made up of large, mid-size, and small U.S. companies within the healthcare sector.

The VHT ETF aims to hold each stock in approximately the same proportion as it appears in the index. It has $17.93 billion in AUM and an expense ratio of 0.1%. Its top 10 holdings contribute 47.94% of the portfolio. Over the past six months, VHT ETF has generated a return of 6.9%.

On TipRanks, VHT has a Moderate Buy consensus rating based on 347 Buys, 60 Holds, and seven Sells assigned in the last three months. At $321.64, the average VHT ETF price target implies a 19.27% upside potential.

Vanguard S&P 500 Growth ETF

The VOOG ETF allows investors to gain exposure to large-cap U.S. growth stocks. This ETF tracks the S&P 500 Growth Index, which includes companies with above-average growth potential. VOOG offers a diversified portfolio of companies across various sectors, including technology, healthcare, and consumer discretionary.

It has $13.47 billion in AUM, with the top 10 holdings contributing 60.19% of the portfolio. Meanwhile, the expense ratio of 0.1% is encouraging. Interestingly, the VOOG ETF has generated a return of 21.7% over the past six months.

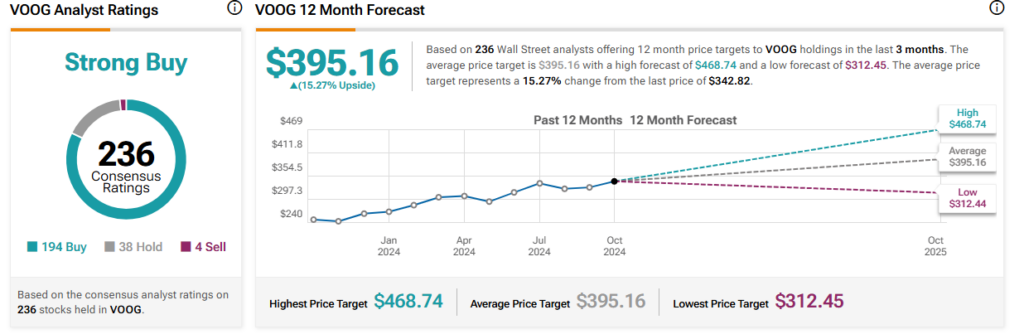

On TipRanks, VOOG ETF has a Strong Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 236 stocks held, 194 have Buys, 38 have a Hold rating, and four stocks have a Sell rating. The average VOOG ETF price target of $395.16 implies a 15.27% upside potential from the current levels.

Concluding Thoughts

The Vanguard ETFs offer several benefits, such as exposure to several companies, low cost, and long-term capital appreciation opportunities. Furthermore, these ETFs have better liquidity, allowing investors to buy and sell shares conveniently without sacrificing returns.