While in some cases, people use their cell phone as a replacement for their landline home phone, most use their cell phone as an emergency tool while they’re out of the house. That makes roaming a particularly vital service that Verizon (NYSE:VZ) recently dropped the ball on. In fact, Verizon shares slipped fractionally in Thursday afternoon’s trading as it worked to fix some roaming troubles it recently encountered.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The problem seems limited to customers who are roaming outside the United States. With summer travel season in full swing, it’s more likely than normal right now to run into such an issue. Calls and data connections are successful “about 70 percent of the time,” a Verizon rep noted. Meanwhile, that same rep said that Verizon is “actively working with our roaming provider to resolve the issue.” In fact, reports suggest it’s not just Verizon that is having this roaming trouble but also AT&T (NYSE:T) and T-Mobile (NASDAQ:TMUS).

New Logo, New Streaming

Verizon has made some smaller changes to attempt to draw interest. It modified its logo, turning it into a “glowing V” that looks somewhat similar to Netflix’s (NASDAQ:NFLX) big N. It’s also offering up some new deals to draw interest, offering the myHome program, which offers a variety of internet options, a live TV option, and content add-ons from there at a price guaranteed for as long as four years with no equipment charges or other “hidden fees.”

Is Verizon Stock a Buy, Sell, or Hold?

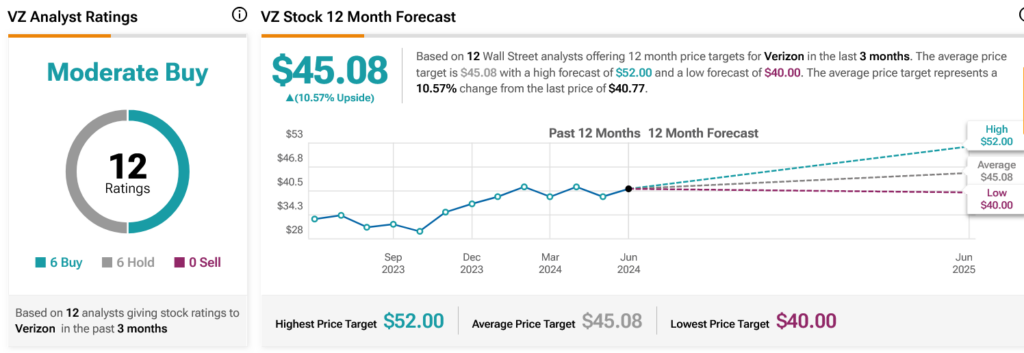

Turning to Wall Street, analysts have a Moderate Buy consensus rating on VZ stock based on six Buys and six Holds assigned in the past three months, as indicated by the graphic below. After an 18.85% loss in its share price over the past year, the average VZ price target of $45.08 per share implies 10.57% upside potential.