Verint (NASDAQ:VRNT) delivered better-than-expected Q1 Fiscal 2025 results. The company’s management raised full-year sales and EPS guidance, suggesting that the momentum in its business will likely be sustained. Thanks to the Q1 beat and upward adjustment in guidance, VRNT stock jumped 8.6% in Tuesday’s after-hours trading.

Verint is a leading customer experience (CX) automation company. It provides cloud-based software solutions for customer engagement. The company benefits from growing demand for its artificial intelligence (AI)-powered open platform. During the Q1 conference call, the company’s leadership indicated that it is likely to benefit from expanding addressable markets as more brands adopt its AI-powered bots.

With this backdrop, let’s delve into Verint’s Q1 performance.

Verint: Q1 Sales and EPS Exceed Expectations

The company reported sales of $221.28 million in Q1, up 2% year-over-year. It’s worth noting that the company’s top line increased 5% year-over-year when adjusted for the divestiture of its quality-managed services business. Moreover, its sales exceeded the Street’s expectations of $214.53 million.

Verint’s software as a service (SaaS) bookings were strong, driven by growing customer adoption of its AI-powered bots. The company’s bundled SaaS ACV (Annual Contract Value) bookings in Q1 increased by 25% and witnessed large customer wins.

The company reported adjusted earnings of $0.59 per share in Q1, up about 11% year-over-year. Moreover, its EPS surpassed analysts’ average estimate of $0.54. TipRanks’ earnings page shows that VRNT has exceeded analysts’ estimates in the past three consecutive quarters.

Guidance Raised

Verint’s leadership raised Fiscal 2025 sales and EPS guidance due to the better-than-expected Q1 performance and solid AI-led demand.

The company expects Fiscal 2025 revenue to be $933 million (+/- 2%), reflecting a year-over-year growth of 5%. Earlier, VRNT projected its top line to be $930 million (+/-2%).

It now expects EPS to be $2.90, reflecting 6% year-over-year growth, up from its previous outlook of $2.89.

Is Verint Systems a Buy?

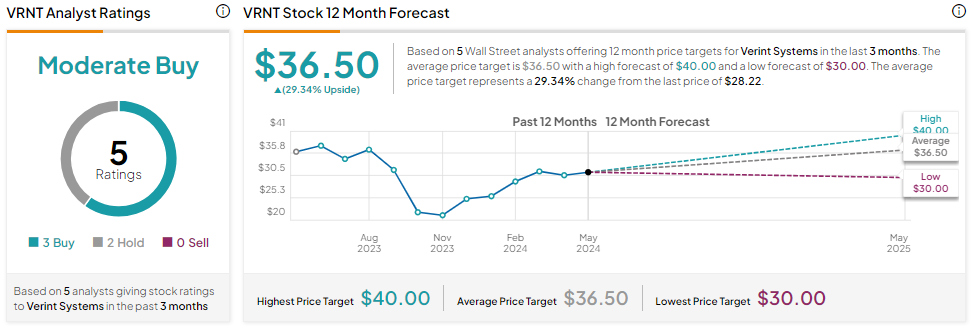

Verint Systems stock has underperformed the broader markets over the past year and is down about 23.4%. Looking ahead, Wall Street analysts are cautiously optimistic about its prospects.

Verint Systems stock has three Buys and two Holds for a Moderate Buy consensus rating. Analysts’ average price target on VRNT stock is $36.50, implying an upside potential of 29.34% from current levels.