Shares of Vaxart cratered 58% on Feb. 3 after early preliminary trial data showed that its oral COVID-19 vaccine did not produce neutralizing antibodies in “most subjects.”

At the same time, Vaxart (VXRT) reported that the preliminary data from the Phase 1 study of VXA-CoV2-1, its oral COVID-19 tablet vaccine candidate, did trigger multiple immune responses against SARS-CoV-2 antigens, but neutralizing antibodies weren’t detected. Following the study, a total of 495 individuals have now been dosed with Vaxart’s platform, with no serious adverse events.

“Our results highlight the importance of our differentiated vaccine design, as they suggest VXA-CoV2-1 could have broad activity against existing and future coronavirus strains,” said Vaxart CEO Andrei Floroiu. “These results are timely, as we are seeing the emergence of new variants less responsive to first generation vaccines, thus making potential cross-reactivity another important advantage of next-generation vaccines.”

According to the findings of the Phase 1 study, VXA-CoV2-1 induced potent T-cell responses to the viral Spike (S) protein as well as an increase in plasmablast cell number, indicating the activation of B cells. In addition, the data showed an increase in proinflammatory Th1 cytokines, which are responsible for triggering the immune response to viral infection.

“T-cells can provide long-lasting cross-reactive protection against current and emerging strains of the virus. Our vaccine induced a high percentage of responding CD8+ T cells against both Spike (S) and Nucleoprotein (N) proteins, which may provide protection against variants with alterations in the faster-changing S protein,” Vaxart’s Chief Scientific Officer said. “We expect that our vaccine will be less impacted by new variants than injectable vaccines.”

Vaxart shares, which have surged 73% so far in 2021, are up a stellar 804% over the past year. (See Vaxart stock analysis on TipRanks)

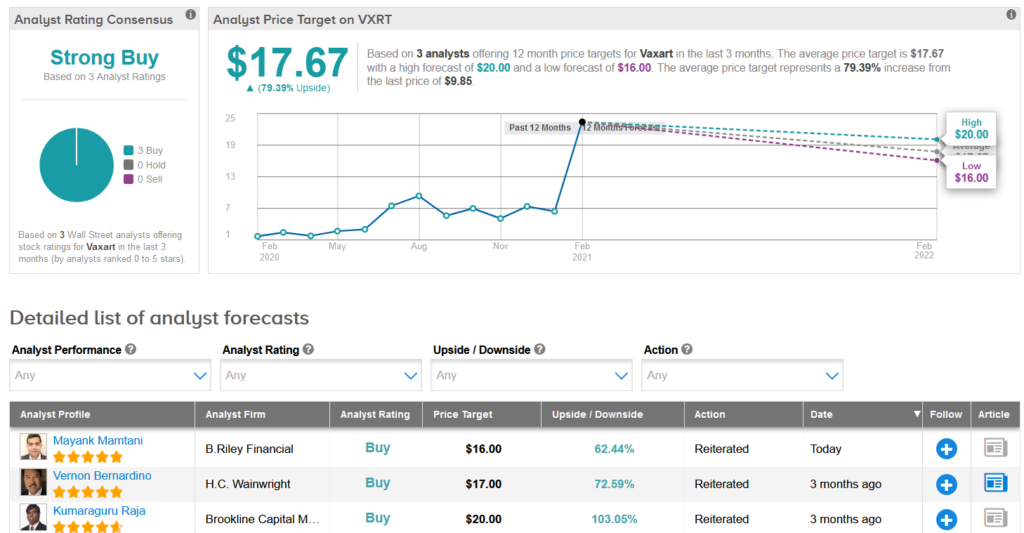

Following the data release, FBR Riley analyst Mayank Mamtani maintained a Buy rating on the stock with a $16 price target, as he believes that “expectations going into this readout were quite elevated.”

“We remain intrigued with the unequivocally robust benefit noted on T cell responses, including relative to its in-class peers in the form of adenoviral vector-based C-19 vaccine candidates, particularly as it relates to the potential role in demonstrating long-lasting crossreactive immunity,” Mamtani wrote in a note to investors. “In addition, we are also encouraged by safety profiles.”

Overall, two other analysts have picked up coverage of the stock, with a Buy rating. Vaxart, therefore, scores a Strong Buy consensus rating alongside an average analyst price target of $17.67. The figure suggests upside potential of 79% in the year ahead.

Related News:

Cassava Shares Go Through The Roof On Alzheimer Drug Trial Results

Chipotle’s 4Q Profit Disappoints Due To COVID-19 Costs; Shares Slip

Match Group Sinks 6% Pre-Market On 4Q Profit Miss