With iron ore markets tight and margins at astronomical levels, Vale SA (VALE) has announced that its board of directors have approved the implementation of the Serra Sul 120 Project, in Canaã dos Carajás, Brazil.

The Serra Sul 120 Project consists of increasing the S11D mine-plant capacity by 20 Mtpy, which will total 120 Mtpy at site, and has total multiyear investments of $1.5 billion. Its start-up is expected in the first half of 2024.

The project includes: (i) the opening of new mining areas; (ii) the duplication of the long-distance belt conveyor; (iii) the implementation of new processing lines at the plant; (iv) the expansion of storage areas.

According to Vale, the Serra Sul 120 Project will create an important buffer of productive capacity to face eventual production or licensing restrictions in the Northern System.

Investments in the mine-plant together with the logistics solution under development aim to increase the Northern System’s total capacity in 20 Mtpy, to 260 Mtpy.

With the Serra Sul 120 Project and the delay in the execution of projects in 2020 due to the COVID-19 pandemic, Vale says that it will update in due course its $5 billion investment guidance for 2021.

“Perhaps more important than the incremental 20mtpa capacity are the operational flexibility and redundancy that will be built into the existing S11-D system” commented RBC Capital’s Tyler Broda following the news.

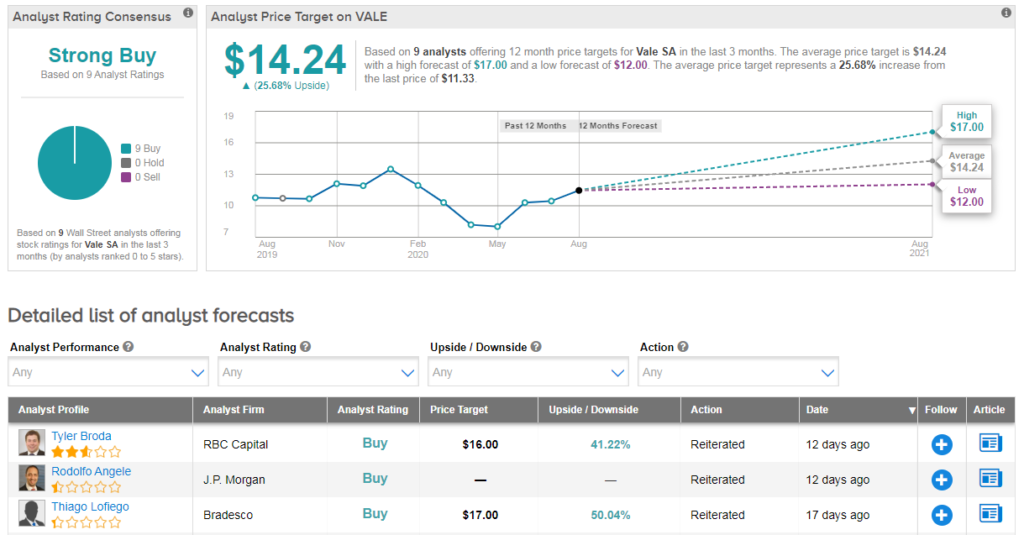

He has a buy rating on Vale and $16 price target, adding “although not separately disclosed, we believe S11-D is at the bottom end of Vale’s iron ore cost curve and the incremental tonnes, which will likely serve to replace Southern or Southeastern system capacity, and should marginally reduce medium-term cash costs.”

He believes the project will see VALE upgrade its already sector-leading iron ore portfolio, and says the stock looks attractive even on base-case forecasts, which imply a $65/t iron ore price from 2022. (See Vale SA stock analysis on TipRanks)

Indeed the stock shows a bullish Strong Buy Street consensus, with nine back-to-back recent buy ratings. The average analyst price target indicates the stock can surge 26% from current levels. Shares are currently trading down 14% year-to-date.

Related News:

Buffett Builds Position In Barrick Gold, Says Goodbye To US Banks

DraftKings Sinks As IRS Tax Threat Hits; Street Stays Bullish

Altria vs Philip Morris: Which Stock Is A More Compelling Buy?