Global mountain resort operator Vail Resorts, Inc. (MTN) delivered mixed fourth-quarter and full-year 2021 results, which were negatively impacted by COVID-19-related resort closures and travel restrictions.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company also announced a $320 million transformational capital plan for the 2022 calendar year. Shares sank 1.4% in the extended trading session on September 23.

Vail reported a quarterly loss of $3.49 per share, missing analysts’ estimated loss of $3.46 per share. In the prior-year quarter, MTN posted a loss of $3.82 per share. (See Vail Resorts stock charts on TipRanks)

On a positive note, net revenue grew a whopping 164.5% compared to the year-ago period to $204.20 million and outpaced analysts’ estimates of $185.9 million. During the fourth quarter, the company witnessed strong demand across its North American summer operations. MTN also saw strong demand trends at the beginning of the 2021 Australian ski season.

For full-year 2021, Vail Resorts posted earnings of $3.13 per share, up 29.3% year-over-year, while net revenue declined 2.6% to $1.91 billion. Results were impacted by the pandemic-related early closure of Whistler Blackcomb on March 30, 2021, as well as periodic resort closures affecting Australian ski areas.

Commenting on the financial performance, Rob Katz, CEO of the company said, “Given the continued challenges associated with COVID-19, we are pleased with our operating results for the year. Our results highlighted our data-driven marketing capabilities, the value of our pass products, the resiliency of demand for the experiences we offer throughout our network of world-class resorts, and our disciplined cost controls.”

As part of the company’s new initiative for CY22 called “Epic Lift Upgrade,” MTN proposes to materially reduce wait times and increase uphill capacity with 12 new high-speed chairlifts, a new high-speed gondola, 6 new fixed-grip chairlifts, new lift-served terrain, and an expanded restaurant.

Additionally, the company rewarded shareholders by declaring a cash dividend of $0.88 per common share, payable on October 22, 2021, to shareholders of record on October 5, 2021.

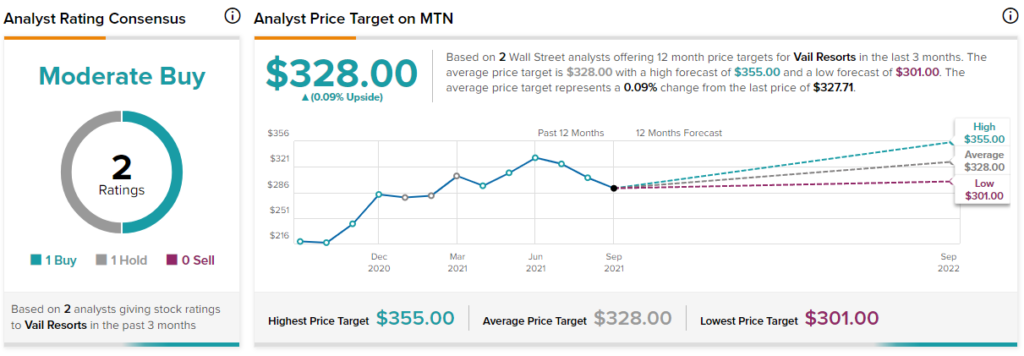

Recently, Deutsche Bank analyst Chris Woronka lifted the price target on the stock to $301 (8.2% downside potential) from $298 while maintaining a Hold rating.

In Vail’s first-quarter results, Woronka viewed the company’s pass sales for the upcoming ski season to be the most important factor to watch.

Woronka said, “Our view is that the sales pace could be better than the +15% to +20% range and we are aware of some bulls that believe it could be essentially flat vs. the June figure of +33%. We believe the volume of upgrades from restricted passes to a full, unrestricted Epic Pass could surprise to the upside and we note that upgrades have the effect of more than offsetting the 20% price cut (i.e., this still counts as only one pass being sold but results in $54 of incremental revenue for MTN).”

Overall, the stock has a Moderate Buy consensus rating based on 1 Buy and 1 Hold. The average Vail Resorts price target of $328 implies that shares are fully valued at current levels. Shares have gained 46.2% over the past year.

Related News:

Weyerhaeuser Declares Interim Dividend & New $1B Share Buyback Program

Workhorse Group Provides Update on Strategic Plans; Shares Plunge 10%

Blink Launches First Publicly Accessible EV Charging Station