Vail Resorts reported wider-than-expected 4Q loss after the market closed on Thursday. The company, which operates mountain resorts and urban ski areas, posted a loss of $3.82 per share in the July-ending fourth quarter, as compared to the analysts’ expectations of a loss of $3.47 per share. In the prior-year quarter, the company reported a loss of $2.22 per share.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Vail Resorts’ (MTN) 4Q revenue of $77.2 million missed the Street estimates of $138.3 million. Further, revenues declined 68% year-over-year due to the closure of the North American mountain resorts and regional ski areas.

Despite disappointing 4Q numbers, shares rose 1.24% in the extended trading session after Vail Resorts reported that “Season pass sales through September 18, 2020, for the upcoming 2020/2021 North American ski season increased approximately 18% in units.” However, revenue from these sales was down 4% year-over-year, as the company had to offer credits to 2019/2020 Epic Pass holders who could not use their pass due to the pandemic. Without deducting the credits, sales were up 24% for the upcoming 2020/2021 ski season.

The company’s CEO Rob Katz said “Given the broader dynamics in the travel industry, we do expect to see material declines in visitation to our resorts and associated revenue declines in fiscal 2021 relative to our original visitation expectations for fiscal 2020, primarily as a result of expected declines in visitation from non-pass, lift ticket purchases.” (See MTN stock analysis on TipRanks)

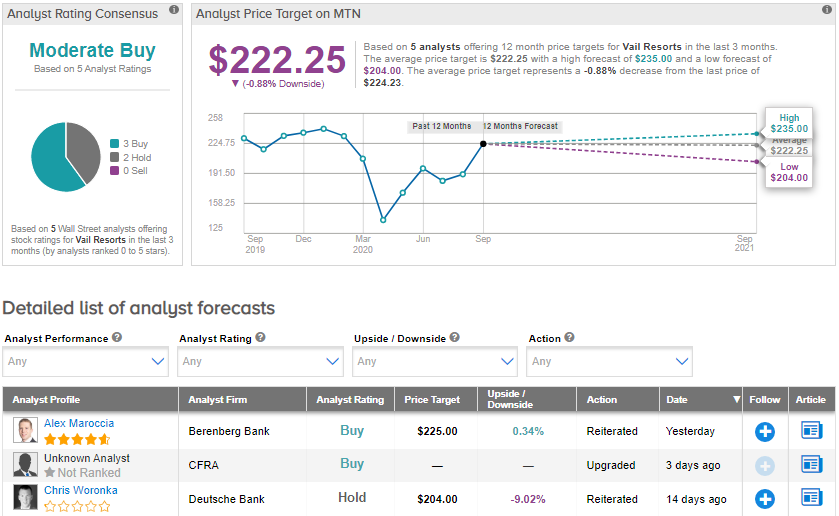

Berenberg Bank analyst Alex Maroccia maintained a Buy rating and a price target of $225 (0.34% upside potential) on Vail Resorts on Epic pass demand. However, he also expects “revenues and EBITDA could be down materially versus original expectations” due to travel restrictions and uncertain spending environment, despite strong Epic Pass customer retention.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 3 Buy ratings and 2 Holds. The average price target of $222.25 implies that the shares are fully priced at current levels. Shares have declined about 6.5% year-to-date.

Related News:

Darden Restaurants Gains 6% On 2Q Profit Guidance

IBEX Rises 3% On Upbeat 4Q Sales Results

Owens & Minor Soars 47% After Boosting Its Earnings Outlook Again