Urban Outfitters (URBN) has shown promising growth in the second quarter, with a notable focus on profitability. Despite operating costs exceeding revenue growth, the company’s net income saw an impressive rise of 16.94% from a year ago. Furthermore, there has been an increase of 23.2% in the annual growth of earnings per share, signifying improved profitability even after dividend distribution. Yet, the company has confirmed investors’ concerns about a slowdown in sales in the third quarter.

Expectations of a mid-single-digit year-over-year increase in Q3 sales and a contraction of gross margins led to a roughly 20% dip in its shares. The decline has pushed the stock into value territory. With plans to expand its presence in Europe, the Middle East, and Asia over the next three years, it could be an attractive window for value investors to entertain adding a position in this apparel stock.

Urban Outfitters Seeks To Cater to a Broader Market

Urban Outfitters is a lifestyle brand that offers a range of products to various demographics through its different store brands and subscription services. It offers women’s and men’s fashion apparel, activewear, footwear, home goods, and more. It sells its products through Urban Outfitters, Anthropologie, Terrain, Free People retail stores, and the Nuuly subscription service.

The company’s Q2 results showcased stable retail sales momentum, especially with Anthropologie and Free People. However, the Urban Outfitters brand has declined, affecting the overall margin expansion despite significant growth in the Nuuly subscription service. Management has outlined a plan for improvement, including expanding the product range to cater to a broader market, optimizing store locations, and reducing reliance on promotions.

Urban Outfitters’ Recent Financial Results

The company recently posted financial results for Q2 2024. Revenue rose to $1.35 billion, slightly exceeding analysts’ projections of $1.34 billion while rising 6.3% year-over-year. Sales across the portfolio have generally increased, with the retail segment net sales seeing a 3.1% increase, fueled by positive digital and retail store sales strides.

The women’s apparel subscription rental service, Nuuly, showed significant growth, with net sales soaring by 62.6%, chiefly driven by a 55% increase in average active subscribers. The gross profit rate also rose by 68 basis points, growing 8.3% to $493.3 million.

However, SG&A expenses increased by $24.7 million (or 7.6%) due to increased marketing spending to support customer traffic growth and heightened store payroll expenses. The Urban Outfitters brand failed to reduce expenses in line with declining net sales, leading to slight deleverage. The company’s net income for the quarter was $117.5 million, and earnings per share (EPS) came in at $1.24, beating the consensus forecast of $1.00.

As of the quarter’s end, the company reported cash and cash equivalents of $209 million. Also noteworthy, the company repurchased and retired 1.2 million shares for about $52 million as part of a share repurchase program, leaving 18.0 million common shares yet to be acquired.

What Is the Price Target for URBN Stock?

The stock has been on a multi-year upward trend, climbing roughly 10% in the past three years. It trades in the lower half of its 52-week price range of $30.05 – $48.90 and shows negative price momentum by trading below its 20-day (44.08) and 50-day (42.86) moving averages. It trades at a discount to industry peers, with a P/E ratio of 11.41x, compared to the Apparel Retail industry average of 27.14x.

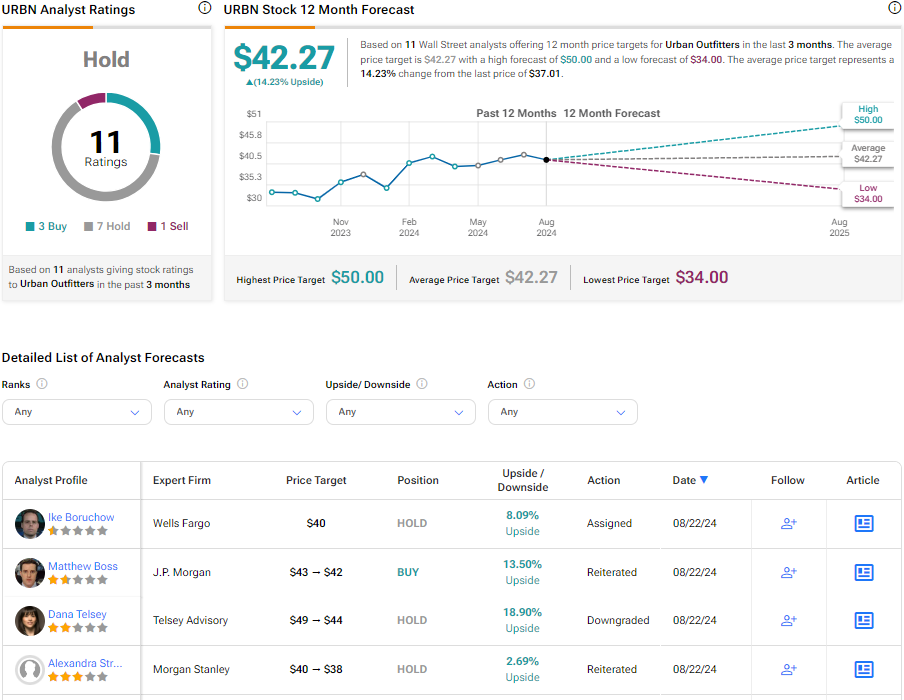

Analysts covering the company have taken a cautious approach to the stock. For instance, Telsey Advisory analyst Dana Telsey recently downgraded the shares from Outperform to Market Perform while adjusting the price target downward from $49 to $44, noting sales trends slowing in the near term, though with a potential improvement in Q4.

Urban Outfitters is rated a Hold based on the recommendations and price targets issued by 12 analysts. The average price target for URBN stock is $42.27, representing a potential 14.23% upside from current levels.

Bottom Line on URBN

Despite a projected slowdown in Q3 sales and a contraction of gross margins, Urban Outfitters’ strategic expansion plans in Europe, the Middle East, and Asia over the next three years present a potentially attractive opportunity for value investors. The recent dip in shares reflects recent challenges highlighted by increased SG&A expenses and a decline in the Urban Outfitters brand. Yet, management’s commitment to broadening its product range and optimizing store locations points to upside potential that could catalyze the stock to higher levels in time.