Upstart Holdings, Inc. (UPST) shares jumped almost 18% in Tuesday’s extended trading session after the company delivered a blowout second-quarter and also raised its FY2021 guidance well above the analyst expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of the U.S.-based artificial intelligence (AI) lending platform have gained over 360% over the past year. (See Upstart Holdings stock charts on TipRanks)

Encouragingly, revenues jumped 1,018% year-over-year to $194 million and exceeded consensus estimates of $157.76 million. The increase in revenues reflected a surge in fee revenues, which increased 1,308% to $187 million.

Adjusted earnings of $0.62 per share significantly beat analysts’ expectations of $0.25 per share. The company reported an adjusted loss of $0.25 per share in the prior-year period.

Upstart CEO Dave Girouard commented, “Our second quarter results continue to show why Upstart has the potential to be among the world’s largest and most impactful FinTechs.”

He further added, “Lending is the center beam of revenue and profits in financial services and artificial intelligence may be the most transformational change to come to this industry in its 5,000 year history.”

Upstart Raises FY2021 Guidance

Based on the outstanding Q2 results, the company raised its guidance for Fiscal 2021. Revenues are now forecast to be $750 million, versus the consensus estimate of $601.1 million. Previously, the company expected revenues of $600 million for the year.

Furthermore, the company now forecasts an adjusted EBITDA margin of 17% versus 10% guided previously.

For Q3, revenues are expected to be in the range of $205 – $215 million, versus the consensus estimate of $161.6 million. Additionally, the company forecasts adjusted EBITDA in the range of $30 – $34 million.

Goldman Sachs analyst Mike Ng recently initiated coverage on Upstart Holdings with a Buy rating and a price target of $147 (8.3% upside potential).

Mike stated, “The company is disrupting the $92bn annual unsecured personal credit origination market and to date commands less than 4% share, though we ultimately believe the company’s technology asset will allow the company to succeed in lending categories well beyond unsecured personal that in aggregate represent a multi-trillion dollar market opportunity, including auto loans, student loans, point-of-sale loans, and HELOCs/mortgages.”

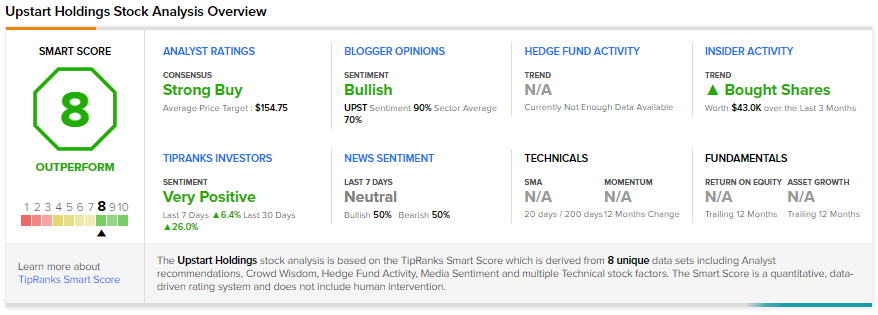

Consensus among analysts is a Strong Buy based on 4 Buys and 1 Hold. The average Upstart Holdings price target of $164.80 implies 21.5% upside potential to current levels.

UPST scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Bentley Systems Posts Q2 Beat and Raises Guidance; Shares Pop 5%

Senseonics Holdings Misses Q2 Earnings, Shares Down 8%

SmileDirectClub Posts Q2 Miss; Shares Fall 13% After-Hours