UPS (UPS) delivered a blowout quarter as the package delivery company posted a 27% year-on-year growth in 1Q revenues to $22.9 billion, topping analysts’ estimates of $20.6 billion. Adjusted diluted EPS of $2.77 per share jumped 141% year-on-year and beat consensus estimates of $1.73 per share.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

UPS CEO Carol Tomé said, “I want to thank all UPSers for delivering what matters, including COVID-19 vaccines. During the quarter, we continued to execute our strategy under the better not bigger framework, which enabled us to win the best opportunities in the market and drove record financial results.”

UPS also said at its earnings call that as of last week, the company had delivered an excess of 1.1 million vaccine shipments, including around 196 million COVID-19 vaccine doses to 50 countries.

UPS stated that for 1Q, “GAAP results include a net benefit of $2.4 billion, or $2.70 per diluted share, comprised of an after-tax mark-to-market (MTM) pension benefit of $2.5 billion and after-tax transformation and other charges of $140 million. The MTM benefit was primarily driven by the enactment of the American Rescue Plan Act of 2021 (ARPA).”

The company did not provide any revenue or EPS guidance for FY21 considering the economic uncertainty but did reaffirm its capital allocation plans and has forecasted capex of about $4 billion. UPS also said that it expects the sale of UPS Freight to close in the second quarter of this year.

The company plans to repay long-term debt of $2.5 billion in FY21. (See UPS stock analysis on TipRanks)

Following the earnings, Oppenheimer analyst Scott Schneeberger raised the price target from $186 to $210 and reiterated a Buy on the stock. Schneeberger said in a note to investors, “We’re increasing our 2021 adjusted EPS to $11.34 (+38% y/y; from $9.06; $9.00E consensus) primarily on UPS’s sizable 1Q21 outperformance.”

“We anticipate sustained B2C [business-to-consumer] volume/pricing momentum, B2B [business-to-business] rebound progression, elevated International activity/margin, and efficiency initiatives to benefit 2021 and 2022, where our adjusted EPS updates to $11.68 (+3% y/y; from $9.66; $9.65E consensus),” Schneeberger added.

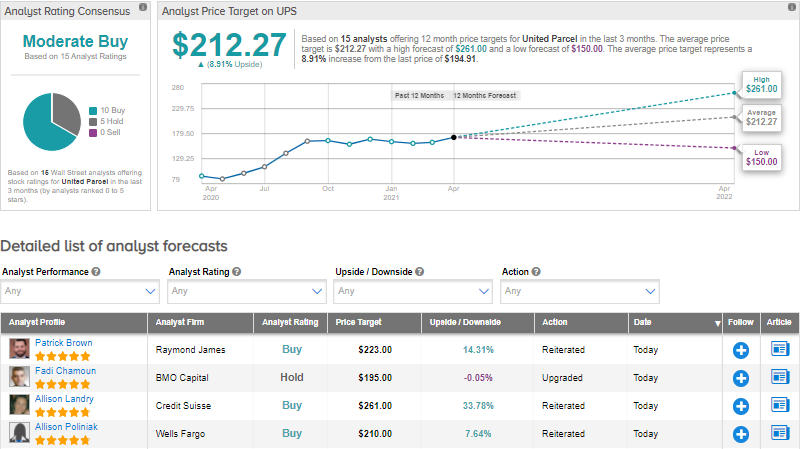

Overall, consensus on the Street is that UPS is a Moderate Buy based on 10 Buys and 5 Holds. The average analyst price target of $212.27 implies upside potential of approximately 8% to current levels.

Related News:

Pinterest’s Monthly Active Users In 1Q Fall Short Of Estimates; Shares Drop 11%

Starbucks Reports Mixed Results In 2Q

Lam Research’s 4Q Guidance Tops Estimates After 3Q Beat