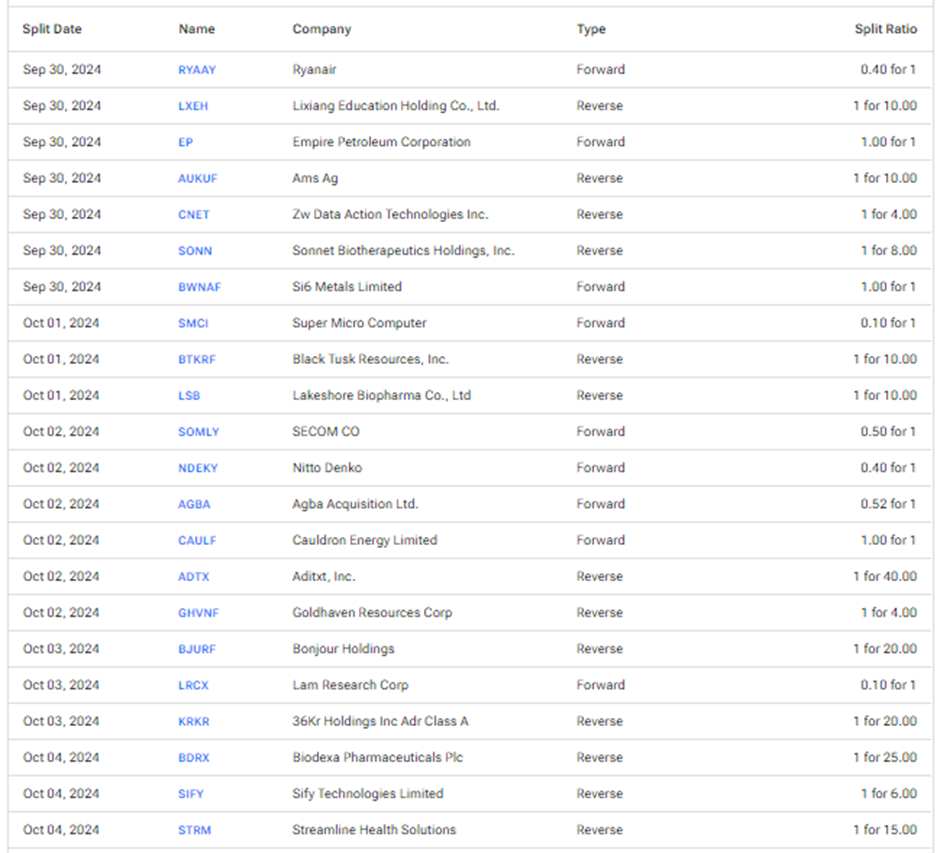

These are the upcoming stock splits for the week of September 30 to October 4, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action in which the company issues additional common shares to increase the number of outstanding shares. Accordingly, the stock price of the company’s shares decreases, which maintains the market capitalization before and after the split.

In contrast, there are also reverse stock splits that reduce the number of outstanding shares (consolidate). In this case, too, the market cap is maintained as the share price increases following the reverse stock split.

Companies often undertake stock splits to improve the liquidity of the common shares and make them more affordable for retail investors. Let’s look quickly at the upcoming stock splits for the week.

Ryanair Holdings (RYAAY) – Dublin-based Ryanair Holdings is a low-cost air carrier across the European route network. On September 15, RYAAY announced a five-for-two stock split of its ADS (American Depositary Shares). The stock split will change the ratio of ADS to ordinary shares from one-to-five to one-to-two. Effective September 30, the ADS will start trading on a split-adjusted basis. Ryanair’s ADS holders will receive one and one and half additional ADSs for each ADS held by them.

Lixiang Education Holding Co. (LXEH) – China-based Lixiang Education Holding provides private primary and secondary education services. On September 26, LXEH announced a one-for-ten reverse stock split of its ADS (American Depositary Shares). The reverse stock split will change the ratio of ordinary shares to ADS from one-to-ten to one-to-100. Effective September 30, the ADS will start trading on a split-adjusted basis.

Empire Petroleum (EP) – Empire Petroleum is a production-driven oil and gas company with current producing assets in New Mexico, North Dakota, Montana, Texas, and Louisiana. The company announced a rights issue of its shares in the ratio 1:1, with an ex-date of September 30 to increase capital. EP intends to raise approximately $10 million in gross proceeds from the rights issue.

ams OSRAM (AUKUF) – Austria-based ams OSRAM AG is a semiconductor company that manufactures advanced light and sensor technologies. On June 14, the shareholders approved a ten-for-one reverse stock split of its common shares, with the effective date for trading being September 30.

ZW Data Action Technologies (CNET) – ZW Data Action Technologies known previously as ChinaNet Online Holdings provides cloud computing, big data, artificial intelligence (AI), and other technologies and professional services. On September 25, ZW Data Action Technologies announced a one-for-four reverse stock split of its common stock to regain compliance of Nasdaq’s minimum bid price requirement for continued listing. Shares are expected to start trading on a split adjusted basis on September 30.

Sonnet Biotherapeutics (SONN) – Sonnet Biotherapeutics is a clinical-stage biotechnology company that focuses on developing five cytokine-derived product candidates for treating cancer. On September 25, Sonnet announced a one-for-eight reverse stock split of its common shares to be effective September 30. The reverse split is aimed to increase the per share trading price of SONN shares to satisfy the minimum bid price requirement for Nasdaq listing.

Si6 Metals (BWNAF) – Australia-based Si6 Metals is a mineral exploration company with a focus on battery and precious metals. On September 25, Si6 announced a 1:1 rights issue to raise funds for exploration at its Lithium Valley, Pimento, and Monument projects. Moreover, the company seeks shareholder approval for a one-for-20 reverse stock split set for a future date.

Super Micro Computer (SMCI) – Super Micro Computer manufactures servers and other hardware products and is one of the major beneficiaries of the AI revolution. On August 6, SMCI announced a ten-for-one stock split of its common stock, to be effective October 1.

Q Precious & Battery Metals Corp. (BTKRF) – Q Precious & Battery Metals, previously known as Black Tusk Resources is a Canadian-based minerals exploration company. On September 25, the company announced a ten-for-one reverse stock split of its common stock to improve its per share trading price and trading liquidity. The shares will start trading on a split adjusted basis on October 1.

LakeShore Biopharma (LSB) – LakeShore Biopharmaceuticals is a biopharmaceutical company with a focus on research and developing vaccines and other immune products in the field of infectious diseases. On September 27, the company’s shareholders approved a ten-for-one reverse stock split of its common stock. The shares will start trading on a split adjusted basis on October 4.

Secom Co. Ltd. (SOMLY) – Japan-based Secom is security services provider. Secom announced a two-for-one stock split of its common shares to be effective October 2.

Nitto Denko (NDEKY) – Japan-based Nitto Denko produces adhesives, industrial tapes, touch panels, insulation, vinyl, and other hygiene products. On September 25, NDEKY announced a five-for-one stock split of its common stock to be effective October 2.

AGBA Group Holding (AGBA) – Hong-Kong based AGBA is a financial services company that offers business-to-business (B2B) platform, healthcare and wellness services, fintech businesses, as well as financial advisory services. AGBA’s shareholders approved a forward stock split in the ratio of 1.9356, to be effective October 2.

Cauldron Energy Ltd. (CAULF) – Australia-based Cauldron Energy Ltd. is a uranium exploration company. The company announced new securities issuance of over 112 million new fully paid ordinary shares with a record date of October 3.

ADiTx Therapeutics (ADTX) – ADiTx Therapeutics is a pre-clinical stage life science company with a focus on restoring immune tolerance and delivering long-lasting treatment results for chronic diseases. On September 27, ADiTx announced a one-for-40 reverse stock split of its common stock. The shares will start trading on a stock adjusted basis on October 2.

GoldHaven Resources (GHVNF) – Canada-based GoldHaven Resources is a junior exploration company, focused exploration of gold projects. On September 26, GoldHaven announced a one-for-four reverse stock split to be effective on October 2.

Bonjour Holdings Ltd. (BJURF) – Hong-Kong-based Bonjour Holdings is a chain of retail stores selling beauty and lifestyle products in Hong Kong and Macau. On September 3, the company announced a one-for-twenty reverse stock split of its common shares, to be effective October 3.

Lam Research (LRCX) – Lam Research is an American wafer fabrication equipment manufacturer and supplier to the semiconductor industry. The company is expected to undergo a stock split in the ratio of ten-for-one, effective October 3.

36Kr Holdings (KRKR) – 36Kr Holdings operates an online media publishing portal that provides business services, including online advertising services, enterprise value-added services, and subscription services. On September 19, KRKR announced a one-for-20 reverse stock split of its ADS (American Depositary Shares) to increase the per share trading price of its ADS. The reverse stock split will change the ratio of ordinary shares to ADS to one-to-500 from one-to-25. Effective October 3, the ADS will start trading on a split-adjusted basis.

Biodexa Pharmaceuticals (BDRX) – Biodexa is a clinical-stage biotechnology company focused on developing treatment for oncology and other therapeutic areas. On September 19, BDRX announced a one-for-25 reverse stock split of its ADR (American Depositary Receipt). The reverse stock split will change the ratio of ordinary shares to ADR from one-to-400 to one-to-10,000. Effective October 4, the ADR will start trading on a split-adjusted basis.

Sify Technologies Ltd. (SIFY) – India-based Sify Technologies is an information technology and communications services provider. On September 19, Sify announced a reverse stock split of its common shares in the ratio of one-for-six, effective October 4.

Streamline Health Solutions (STRM) – Streamline Health Solutions offers integrated solutions, technology-enabled services, and analytics that drive compliant revenue leading to improved financial performance across the enterprise. On September 26, the company announced a one-for-15 reverse stock split of its common stock to comply with Nasdaq’s minimum bid price requirement. The shares will start trading on a split adjusted basis on October 4.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.