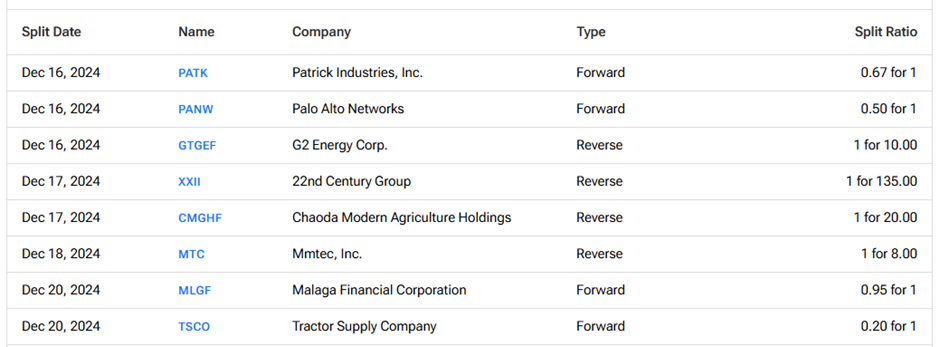

These are the upcoming stock splits for the week of December 16 to December 20, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action in which the company issues additional common shares to increase the number of outstanding shares. Accordingly, the stock price of the company’s shares decreases, which maintains the market capitalization before and after the split.

In contrast, there are also reverse stock splits that reduce the number of outstanding shares (consolidate). In this case, too, the market cap is maintained as the share price increases following the reverse stock split.

Companies often undertake stock splits to improve the liquidity of the common shares and make them more affordable for retail investors. Let’s look quickly at the upcoming stock splits for the week.

Patrick Industries, Inc. (PATK) – Patrick Industries is engaged in the manufacturing of components products and distribution of building products for industrial markets. Some of its end markets include recreational vehicles, marine, manufactured housing, residential housing, hospitality, kitchen cabinets, and office and household furniture. On November 19, the board approved a three-for-two stock split in the form of a stock dividend to be effective December 13.

Accordingly, shareholders will receive one additional share for every two shares held as of the record date. PATK stock is expected to start trading on a split-adjusted basis on December 16.

Palo Alto Networks (PANW) – Palo Alto Networks is one of the largest cybersecurity companies in the U.S. The company offers network security, on-cloud protection, and endpoint security solutions to corporates, service providers, and government entities. On November 20, along with its Q1 FY25 results, PANW announced that its board had approved a two-for-one stock split of its common stock. The split became effective on December 13 and shares will start trading on a split-adjusted basis today.

Green 2 Blue Energy Corp. (GTGEF) – Canada-based Green 2 Blue Energy Corp. owns and operates a wood pellet production plant in Poland. The wood pellets are made from residual sawdust and wood waste, helping to reduce CO2 emissions while producing electricity. On December 11, Green 2 Blue Energy announced a one-for-ten reverse stock split of its common stock for greater liquidity. GTGEF shares are expected to start trading on a split-adjusted basis on December 16.

22nd Century Group, Inc. (XXII) – 22nd Century Group is an agricultural biotechnology company that aims to reduce nicotine biosynthesis in tobacco plants and products to up to 95%. On December 13, the company announced a one-for-135 reverse stock split of its common stock. The split will help in regaining compliance with Nasdaq’s minimum bid price requirement of $1 per share for continued listing. XXII shares are expected to start trading on a split-adjusted basis on December 17.

Chaoda Modern Agriculture Holdings (CMGHF) – Hong Kong-based Chaoda Modern Agriculture Holdings operates as a holding company and is engaged in the production and sale of agricultural products. On December 13, Chaoda announced a one-for-20 reverse stock split of its common stock to be effective on December 17.

MMTec Inc. (MTC) – China-based MMTec is a global financial services provider with a focus on investment banking and asset management services. On November 21, MMTec’s board approved a one-for-eight reverse stock split of its common stock. Shares are expected to start trading on a split-adjusted basis on December 18.

Malaga Financial Corp. (MLGF) – California-based Malaga Financial engages in the provision of community banking services through its subsidiary Malaga Bank. On November 15, Malaga Financial announced a 5% stock split in the form of a stock dividend, to be payable to holders of record on December 20. On the same day, shareholders will also receive a quarterly cash dividend of $0.25 per share.

Tractor Supply Co. (TSCO) – Tractor Supply Co. offers farm and ranch products such as truck and automotive, lawn and garden equipment, outdoor living, and power equipment. On December 5, TSCO announced a five-for-one stock split of its common stock to be payable to shareholders of record on December 16. TSCO shares are expected to start trading on a split-adjusted basis on December 20.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.