Shares of healthcare services major UnitedHealth Group (NYSE:UNH) are on the rise today after its third-quarter EPS of $6.56 landed better than estimates by $0.23. Clocking a year-over-year growth of 14.2%, revenue of $92.36 billion also outperformed expectations by $950 million.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A combination of a higher number of people served at Optum and UnitedHealthcare and a broadened scope of services helped drive growth during the quarter. Further, the medical care ratio came in at 82.3%, compared to 81.6% in the year-ago period.

Revenue at UnitedHealthcare soared by 13% year-over-year to $69.9 billion, with the operating margin improving to 6.6% from 6.1% a year ago. Impressively, the number of people served by UnitedHealthcare with medical benefits rose by 1.1 million so far this year. Revenues at Optum also increased by 22% year-over-year to $56.7 billion. Despite a contraction in operating margin, its earnings from operations rose to $3.9 billion from $3.7 billion a year ago.

For Fiscal Year 2023, UNH now expects adjusted EPS to hover between $24.85 and $25, compared to the prior range of $24.70 to $25.

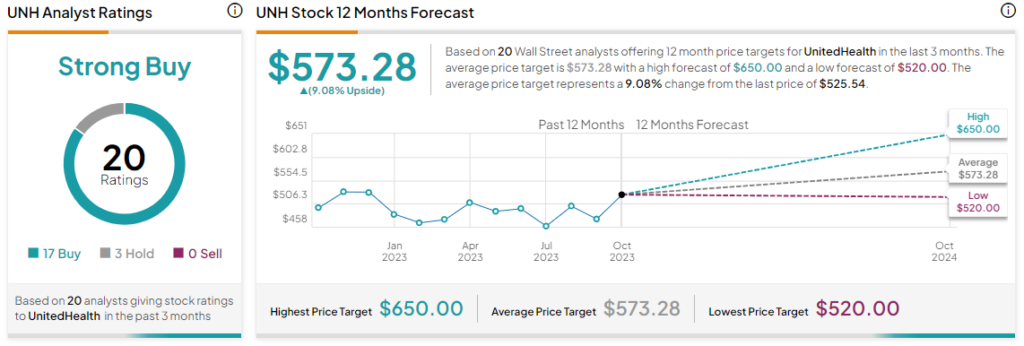

What is the Target Price for UNH?

Overall, the Street has a Strong Buy consensus rating on United Health. The average UNH price target of $573.28 implies 9% potential upside.

Read full Disclosure