Shares of healthcare major UnitedHealth Group (NYSE:UNH) dipped in the early session today despite the company announcing better-than-anticipated results for the fourth quarter. Revenue increased by 14% year-over-year to $94.4 billion. The figure exceeded estimates by nearly $2.2 billion. In addition, EPS of $6.16 outpaced expectations by $0.17.

During the quarter, Optum’s revenue increased to $59.49 billion from $47.87 billion in the year-ago period. Similarly, UnitedHealthcare revenue jumped to $70.81 billion from $63.05 billion in the prior year.

For Fiscal Year 2023, total revenue increased by 15% to $371.6 billion. The company also generated $29.1 billion in cash flow from operations. Further, the medical care ratio stood at 83.2%, and the operating cost ratio came in at 14.7%.

The company expects the sale of its Brazil operations to conclude in the first half of this year. At the same time, it expects an impact on its net earnings outlook from an anticipated charge of $7 billion once the sale process closes. However, the company reaffirmed its prior adjusted earnings expectations and performance objectives for 2024.

Is UNH a Good Buy Right Now?

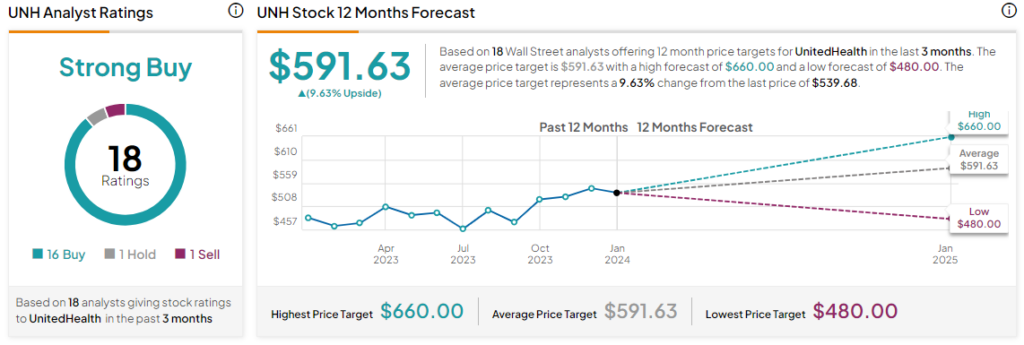

Shares of the company have gained nearly 17% over the past six months. Overall, the Street has a Strong Buy consensus rating on UnitedHealth, and the average UNH price target of $591.63 points to a further 9.6% potential upside in the stock.

Read full Disclosure