Shares of United Therapeutics Corp. jumped 15% after the biotechnology company announced that the US Food and Drug Administration (FDA) has approved its Tyvaso (treprostinil) Inhalation Solution. The therapy is a first-of-its-kind treatment for patients with pulmonary hypertension associated with interstitial lung disease (PH-ILD; WHO Group 3) to improve exercise ability.

Notably, this is the second FDA-approved indication for Tyvaso, which was first approved in July 2009 for the treatment of pulmonary arterial hypertension (PAH; WHO Group 1) to improve exercise ability, the company said.

United Therapeutics (UTHR) said that the US regulator’s decision was based on data from INCREASE, the largest and most comprehensive completed study of adult patients with PH-ILD, which demonstrated significant improvement in six-minute walk distance.

Interstitial lung disease (ILD), a group of lung diseases in which marked scarring occurs within the lungs, leads to pulmonary hypertension (PH; high blood pressure in the lungs) and decreases survival rates. Currently, PH impacts 15% of patients with early-stage ILD and may affect up to 86% of patients with more severe ILD. At present, around 30,000 individuals are PH-ILD patients in the US.

United Therapeutics’ COO Michael Benkowitz said, “With this approval representing such a breakthrough for PH-ILD patients, we’re treating this indication launch with a sense of urgency. We’ve already expanded our field-based teams by 40% to educate the ILD community on the benefits of Tyvaso and how to properly diagnose PH-ILD.” (See United Therapeutics stock analysis on TipRanks)

“We expect rapid uptake of Tyvaso in this indication and expect to double the number of patients on Tyvaso therapy by the end of 2022, barring any COVID-related delays,” he added.

On March 31, Oppenheimer analyst Hartaj Singh maintained a Buy rating and a price target of $275 (43% upside potential) on the stock.

Singh said, “Given UTHR has been trading at compressed multiples to its peer group, we believe the Street is underappreciating: (1) the strength of the UTHR business model, (2) a strong and experienced management team, and (3) newly launched products and pipeline that will help bridge the Adcirca patent loss (25% of 2017 revenues of $1.7B) in mid-2018 and get back to growth.”

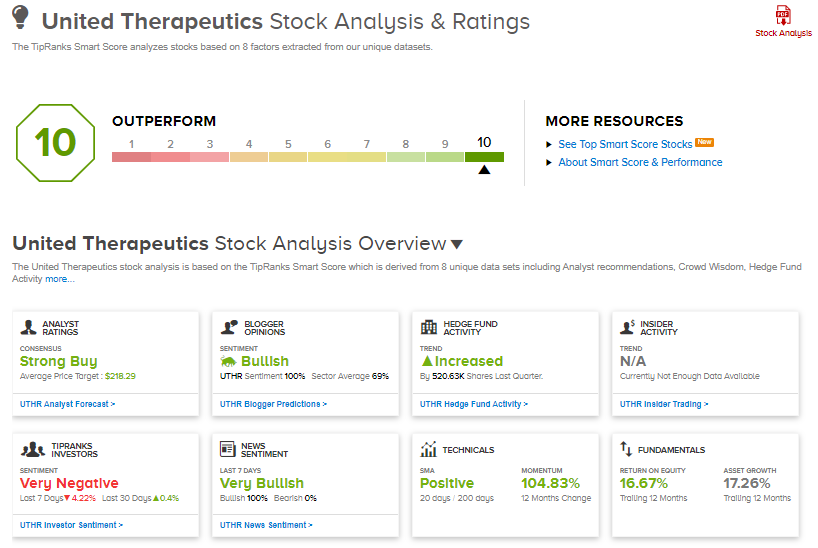

United Therapeutics shares have exploded 105.7% over the past year, while the stock still scores a Strong Buy consensus rating based on 7 unanimous Buys. That’s alongside an average analyst price target of $218.29, which implies 13.5% upside potential to current levels.

Furthermore, United Therapeutics scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Abbott’s BinaxNOW COVID-19 Ag Self Test Cleared For Emergency Use In US

Acuity Brands Pops 13% After 2Q Earnings Beat, Sales Disappoint

Vipshop To Buy Back $500M In Stock; Shares Pop 9%