United Parcel Service (NYSE:UPS) shares are under pressure in the pre-market session today after the logistics major’s third-quarter revenue of $21.1 billion declined by 12.8% year-over-year, missing expectations by $410 million. However, EPS of $1.57 outpaced estimates by $0.05.

Amid an unfavorable macroeconomic environment, the company’s operating profit plummeted by 56.9% to $1.3 billion. Although parcel volume, which had been affected during UPS’ labor negotiations, is beginning to normalize, the average daily volume in the U.S. witnessed an 11.5% decline during the quarter. In sync, the average daily volume in UPS’ International segment saw a 6.6% decline.

For the full Fiscal year 2023, UPS anticipates its top line to be in the range of $91.3 billion to $92.3 billion. Owing to global macroeconomic uncertainty, the company expects its adjusted operating margin to hover between 10.8% and 11.3%.

Separately, UPS announced the acquisition of Happy Returns, a software and reverse logistics company, from PayPal (NASDAQ:PYPL). The acquisition, which bolsters UPS’ small package network, is expected to close in the fourth quarter of 2023.

Is UPS a Good Stock to Buy Now?

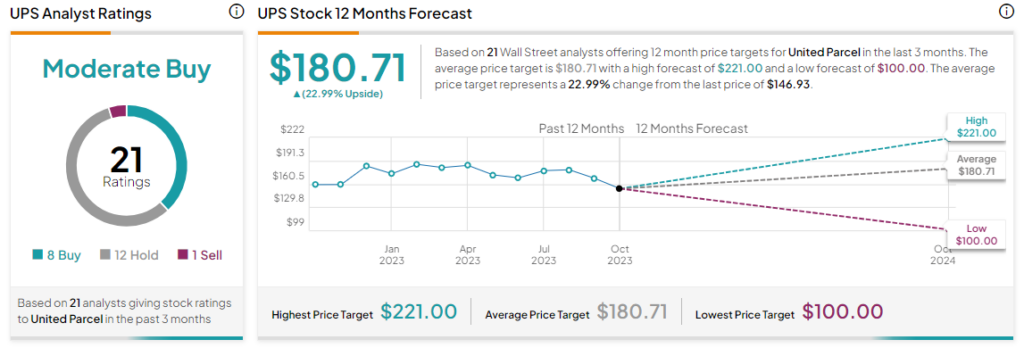

Overall, the Street has a Moderate Buy consensus rating on UPS. After a nearly 16% price correction over the past six months, the average UPS price target of $180.71 implies a 23% potential upside.

Read full Disclosure