United Natural Foods (UNFI), a leading North American distributor of health and specialty foods, has experienced significant growth recently, spurred by a strategy incorporating an innovative commercial go-to-market program for suppliers. The company’s recent earnings report highlighted a 10% increase in net sales, growth in gross profit, and a significant reduction in net debt and net leverage. The share price has increased roughly 60% in the past three months.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

With an improved customer and supplier experience and the introduction of a three-year business plan geared towards enhancing customer and supplier value, margin expansion, and free cash flow generation, UNFI is a compelling option for investors seeking a consumer defensive stock with upside potential.

United Natural Foods Is Growing its Footprint

United Natural Foods distributes natural, organic, specialty, produce, and conventional grocery items in the United States and Canada. The company operates through two main segments – Wholesale and Retail, offering a wide range of products.

United Natural Foods has introduced a new program to simplify partnerships with suppliers, providing enhanced access to data and insights. The company aims to improve the customer and supplier experience through better technology access and a wider product assortment. Additionally, it has unveiled a three-year plan to enhance value and financial objectives.

The company believes the total addressable market of specialty, natural, ethnic, and conventional operators reflects over $90 billion of wholesale sales potential.

United Natural Foods’ Recent Financial Results

The company recently reported results for Q4 of FY 2024. Net sales increased 10% year over year to $8.2 billion, beating analysts’ expectations by $260 million. This performance was attributed to improving volume trends and new business with existing customers. Adjusted EBITDA was $143 million, a marked improvement over the $93 million posted in the fourth quarter of Fiscal 2023. The adjusted earnings per share (EPS) stood at $0.01, exceeding analysts’ estimations by $0.09.

As of the quarter’s end, the company reported total outstanding debt, net of cash, of $2.06 billion, which marks an increase of $115 million during Fiscal 2024. The company’s total reported liquidity was $1.28 billion, including $40 million in cash and an unused capacity of approximately $1.24 billion from the company’s asset-based lending facility.

Following fourth-quarter positive results, UNFI’s management has provided guidance for 2025, projecting net sales between $30.3 and $30.8 billion. It anticipates a net loss of $41 to $3 million, with adjusted earnings per share (EPS) projected to be $0.20 to $0.80. The anticipated Adjusted EBITDA is around $520 to $580 million.

What Is the Target Price for UNFI Stock?

The stock has been on an upward trend, climbing over 44% in the past year. It trades at the high end of its 52-week price range of $8.58 – $19.02 and demonstrates ongoing positive price momentum, trading above its 20-day (15.12) and 50-day (14.36) moving averages. Despite the run-up in share price, the stock trades at a relative value with a P/S ratio of 0.03x, compared to industry peers in the Food Distribution industry, which sports an average P/S ratio of 0.3x.

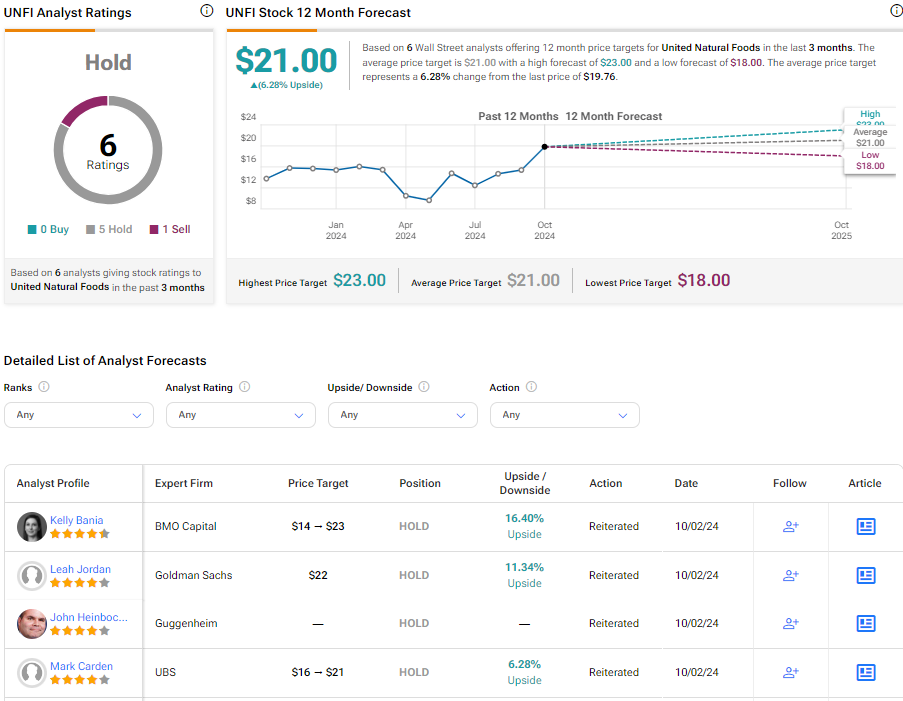

Analysts following the company have taken a cautiously optimistic outlook on the stock. For instance, BMO Capital analyst Kelly Bania recently reiterated a Market Perform rating on the stock while raising the price target from $14 to $23. Bania noted that Q4 results topped expectations, and FY25 guidance points to stable to modest growth.

Based on six analysts’ cumulative recommendations, United Natural Foods is rated a Hold. The average price target for UNFI stock is $21, representing a potential 6.28% change from current levels.

Final Thoughts on UNFI

United Natural Foods has showcased marked growth, with expectations for further upside driven by the company’s improved customer and supplier relationships and strategic three-year business plan. Recent financial results further underscore the company’s positive momentum. The stock trades at a relative discount, making it a potentially appealing option for value-oriented investors.