United Airlines (UAL) reported second-quarter financial results that showed a strong improvement from a year ago and exceeded expectations. Travel demand is rebounding, and United expects to return to profitability soon. United stock rose 6.58% on Tuesday to close at $46.32.

Revenue rose 270.9% year-over-year to $5.5 billion, surpassing consensus estimates of $5.3 billion. Adjusted loss per share narrowed to $3.91 from $9.31 a year ago and came in better than the $4.23 loss per share that Wall Street expected.

United Airlines CEO Scott Kirby commented, “Our airline has reached a meaningful turning point: we’re expecting to be back to making a profit once again.”

The company expects to report an adjusted pre-tax profit in both the third and fourth quarters of 2021. United has not seen a profit since the fourth quarter of 2019.

United expects a full recovery in travel demand by 2023. In anticipation of the strong demand, the company is increasing its capacity with additional routes and more jets. It recently announced the purchase of 270 new aircraft from Boeing and Airbus. (See United stock charts on TipRanks).

Stifel analyst Joseph DeNardi recently reiterated a Hold rating on United Airlines stock but lowered the price target to $52 from $53. DeNardi’s new price target suggests 12.26% upside potential.

The analyst noted United’s plan to expand its profit margins and efforts to revamp its regional businesses as positives. However, the analyst is concerned that capital spending is going to be high and that deleveraging will take several years.

“We’re wary of when investor focus will shift from recovery to post-COVID competitive dynamics which appear likely to be as/more-intense vs. pre-COVID,” commented DeNardi

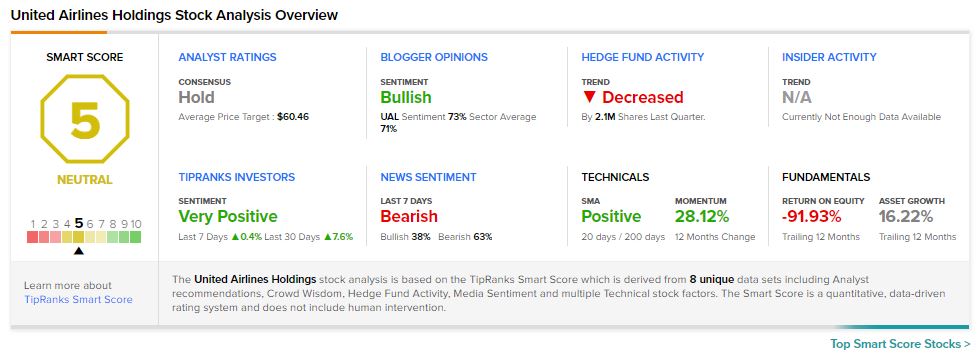

Consensus among analysts is a Hold based on 4 Buys, 9 Holds, and 1 Sell. The average United price target of $60.83 implies 31.33% upside potential to current levels.

UAL scores a 5 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to perform in line with market averages.

Related News:

A Look at Ocean Power’s Risk Factors Post Q4 Results

Carlyle Acquires LiveU; Shares Rise 2.7%

Winnebago Industries to Buy Barletta for $255M; Shares Rise 8%

Questions or Comments about the article? Write to editor@tipranks.com