United Airlines (UAL) will add more than 400 daily flights to its July schedule as it looks to offer travelers more options. The additional flights will address the ever-growing demand for flights as travel destinations come back online.

The airline intends to increase its domestic network in July by 17%, compared to its June flight schedule. As part of the plan, it will add flight banks in Chicago and Washington, D.C. to provide more connection options.

“By adjusting our bank structures at two key hub airports, we’re able to offer our customers easy connections to destinations across the U.S. so they can start their vacations at times convenient for them,” said United Airlines’ domestic network planning and scheduling unit’s VP, Ankit Gupta.

On the international front, United Airlines is resuming and adding new flights to Europe. To ease post-pandemic travel, the airline has updated its mobile app and website to provide a comprehensive list of entry requirements for destinations around the world. The app also offers a digital platform for finding, booking, and uploading COVID-19 tests and entering vaccination records. (See United Airlines stock analysis on TipRanks)

Morgan Stanley analyst Ravi Shanker has reiterated a Hold rating on United Airlines, issuing a second-quarter outlook slightly below consensus.

Shanker stated, “Milestones for the rest of the year look encouraging. Management said that April load factors were slightly behind 2019 with May expected to be ahead with 80%+ for June and beyond – as we noted in our Sep 2020 sector initiation, we expect load factors to be the first revenue metric to normalize this cycle, followed by traffic/available seat miles and finally passenger revenue per available seat mile.”

The analyst has a $65 price target on the stock implying 14.90% upside potential to current levels.

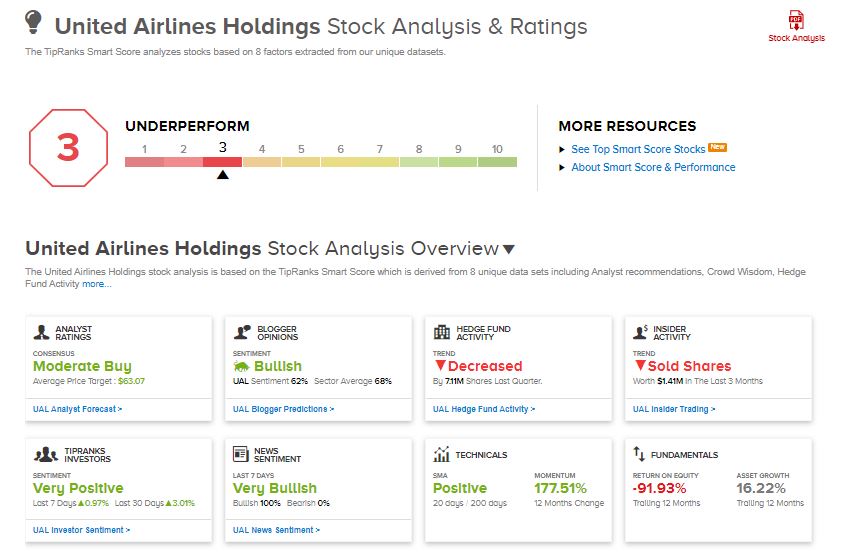

Consensus among analysts on Wall Street is a Moderate Buy based on 8 Buy, 7 Hold, and 1 Sell ratings. The average analyst price target of $63.07 implies 11.49% upside potential to current levels.

UAL scores a 3 out of 10 on TipRanks’ Smart Score rating system, implying it is likely to underperform market expectations.

Related News:

AON to Sell Pension Business to Lane Clark & Peacock LLP in Germany

Beyond Meat Partners with Yum Brands’ Pizza Hut in Canada

AT&T Merging Its WarnerMedia Unit with Discovery in $43B Deal