At TipRanks, we provide investors with several tools to help them select the right stocks. One such tool is the Top Hedge Fund Managers, with which investors can track the investment decisions of leading financial experts. In this article, we will focus on the three stocks that leading hedge fund manager John Kim of Night Owl Capital Management increased his exposure to in the last quarter: UnitedHealth (NYSE:UNH), Fiserv (NYSE:FI), and Visa (NYSE:V).

Before moving ahead, let’s learn about the hedge fund manager, John Kim.

According to the rankings, Kim is fifth among the 487 hedge fund managers evaluated by TipRanks. It should be noted that he has a proven track record, with a cumulative gain of 335.04% since January 2016 and an average return of 28.95% over the past 12 months.

Importantly, a hedge fund manager’s return on a portfolio is best indicated by the Sharpe ratio, which measures the portfolio’s returns against its risks. A Sharpe ratio greater than one means that the portfolio has higher returns than risks. Kim has a Sharpe ratio of 4.9.

With this background, let’s explore what the Street is saying about Kim’s key picks.

Is UNH a Good Buy Right Now?

UnitedHealth offers healthcare products and insurance services. In the first quarter, Kim increased his stake in UNH stock by 12.31%. Currently, UNH makes up 4.23% of Kim’s portfolio.

The company’s strong cash position keeps UNH well poised to expand through strategic acquisitions in the long term. Further, UnitedHealth’s focus on expanding the customer base and leveraging artificial intelligence (AI) keeps it well poised for growth.

Overall, UNH has a Strong Buy consensus rating on TipRanks, based on 18 Buys and two Holds. Further, the analysts’ average price target on UnitedHealth stock of $565.74 implies a 17.61% upside potential to current levels. Shares of the company have declined 7.2% year-to-date.

What Is the Forecast for FI Stock?

Fiserv is a global provider of financial services technology solutions. FI stock currently comprises 5.07% of Kim’s portfolio, following a 10.21% increase in his holdings during the first quarter.

The company’s small business payment solution and the expansion of value-added services reflect its strong growth prospects. Moreover, cooling inflation is expected to boost consumer spending, thereby supporting FI’s performance going forward.

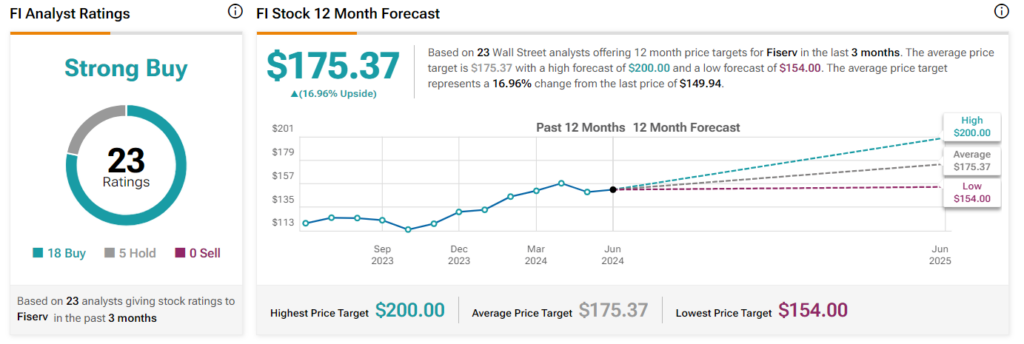

With 18 Buy and five Hold ratings, FI has a Strong Buy consensus rating. On TipRanks, the analysts’ average price target on Fiserv stock of $175.37 implies 16.96% upside potential from current levels. Year-to-date, shares of the company have gained 12.9%.

Is Visa a Buy, Hold, or Sell?

Visa is a global payments technology company. Kim’s portfolio allocation for Visa stock currently represents 5.3%. This marks a 2.31% increase in his holdings during the first quarter alone.

Positive momentum in the consumer payments business and a rebound in cross-border travel should continue to support Visa’s performance. Furthermore, the company’s efforts to introduce new products and services bode well for its long-term growth.

On TipRanks, Visa has a Strong Buy consensus rating. This is based on 20 Buy and four Hold recommendations. The analysts’ average price target on V stock of $316.40 implies 14.3% upside potential. Shares of the company have gained 6.72% so far in 2024.

Concluding Thoughts

Impressive portfolio gains by the leading hedge fund managers may encourage investors to adopt their portfolio allocation strategy. For more ideas on Top Expert Picks, investors can visit the TipRanks Expert Center and make informed investment decisions.