Texas-based Tyler Technologies (TYL) is a software provider to the public sector. In the U.S., it serves government entities. It also has an international footprint with clients in Canada, Australia and the Caribbean. (See Insiders’ Hot Stocks on TipRanks)

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

On October 28, Tyler reported better-than expected results for the third-quarter of Fiscal 2021. Revenue for the quarter stood at $459.9 million against the consensus estimate of $425 million. The company had posted revenue of $285.7 million in the same quarter last year

Quarterly earnings rose to $2.01 per share from $1.50 per share in the same quarter last year and beat the consensus estimate of $1.76 per share. (See Tyler Technologies stock charts on TipRanks).

For 2021, the company anticipates to post revenue in the range of $1.58 billion to $1.60 billion. It expects adjusted EPS for the year in the band of $6.94 to $7.02.

Risk Factors

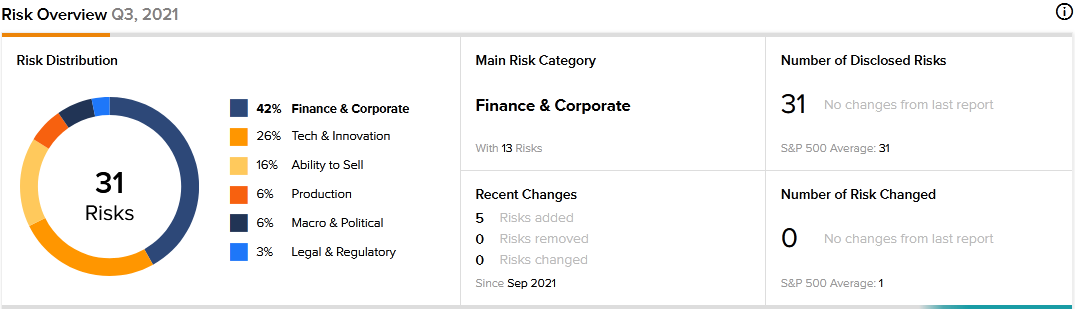

According to the new TipRanks’ Risk Factors tool, Tyler’s top risk categories are Finance & Corporate and Tech & Innovation, which account for 42% and 26%, respectively, of the total 31 risks identified for the stock. Recently, the company has updated its risk profile with five new risk factors.

Tyler has told investors that it is in debt after funding the NIC acquisition. The debts are in the form of loans and convertible notes. It said that it would require a significant amount to service debts. The company acknowledged that its operations may not generate sufficient cash and, therefore, it may be forced to delay investments, sell assets, or seek refinancing. Tyler added that it could default on the debt obligations, which could have an adverse impact on its business and financial condition.

The company has cautioned investors that its debt agreements contain conditions that may restrict its ability to obtain additional financing in the future. The conditions may also limit its ability to participate in some business activities.

Further, Tyler has told investors that some of its debts carry variable interest rates, which could increase the cost of servicing the debts. For a particular debt, for example, the company said that its annual interest expense would go up by $2.1 million due to a quarter point change in interest rate.

The Finance and Corporate risk category’s sector average stands at 48%, compared to Tyler’s 42%. Shares of the company have gained about 24% year-to-date.

Analysts’ Take

Following Tyler’s third quarter earnings report, JMP Securities analyst Joe Goodwin reiterated a Buy rating on the stock with a price target of $580. Goodwin’s price target suggests 7.03% upside potential.

Overall, the Street has a Strong Buy consensus rating based on 6 Buys and 1 Hold. The average Tyler Technologies price target of $587.86 implies 8.48% upside potential.

Related News:

Amgen’s Q3 Results Outperform; Shares Drop on Mixed 2021 Outlook

Bed Bath & Beyond Collaborates with Kroger; Shares Jump 67.5%

Lightspeed to Expand Footprint in Australia and the U.S.