T-Mobile US (TMUS) is an American wireless network operator. It provides mobile communication services, reaching customers through the namesake brand as well as through its Metro by T-Mobile subsidiary. (See Insiders’ Hot Stocks on TipRanks)

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

With this in mind, we used TipRanks to take a look at the newly added risk factor for T-Mobile.

Q3 Financial Results

T-Mobile reported revenue of $19.6 billion for Q3 2021, against $19.3 billion in the same quarter last year but fell short of the consensus estimate of $20.14 billion. It posted EPS of $0.55, compared to $1.00 in the same quarter last year but beating the consensus estimate of $0.52.

T-Mobile gained 1.3 million subscribers in Q3, bringing its total customer count to 106.9 million. It expects to add as many 5.3 million customers in 2021. (See T-Mobile stock charts on TipRanks)

Risk Factors

T-Mobile carries 32 risk factors, according to the new TipRanks Risk Factors tool. The company recently updated its risk profile with one new risk factor.

In the new risk factor, which is in the category of Finance and Corporate, T-Mobile tells investors that it has designated a specific court in Delaware as the specific forum for settling certain disputes against the company or its executives and directors. It says that the choice of a preferred court for resolving disputes may discourage lawsuits against the company. But T-Mobile goes on to caution that if it were forced to settle disputes outside its preferred court, its costs of litigation could increase and adversely affect its business and financial position.

Most of T-Mobile’ risk factors fall under the Finance and Corporate category, with 47% of the total risks. That matches the sector average. T-Mobile’s stock has declined about 10% since the beginning of 2021.

Analysts’ Take

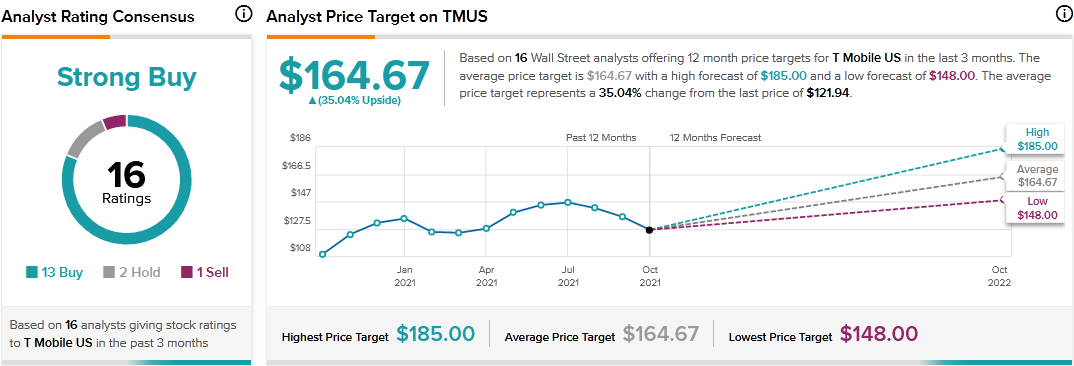

Following T-Mobile’s Q3 earnings report, Raymond James analyst Ric Prentiss reiterated a Buy rating on T-Mobile stock and raised the price target to $158 from $151. Prentiss’ raised price target suggests 29.57% upside potential.

The analyst believes that T-Mobile has a head start in 5G, and that will fuel customer and revenue growth despite the challenges of migrating Sprint subscribers to its network. Furthermore, the analyst noted that when the Sprint subscriber migration is complete, there will be synergies to boost margins, free cash flow, and shareholder returns. For the shareholder returns, Prentiss highlighted T-Mobile’s $60 billion share repurchase plan from 2023 – 2025.

Overall, consensus among analysts is a Strong Buy based on 13 Buys, 2 Holds, and 1 Sell. The average T-Mobile price target of $164.67 implies 35.04% upside potential to current levels.

Related News:

Skillz Drops 10% on Quarterly Loss

Qualcomm Posts a Blowout Quarter; Shares Jump 7.5%

CVS Health: Outlook Outpaces Estimates; Q3 Results Beat