Under Armour’s shares jumped 10% as the athletic apparel retailer surprised investors with posting a profit in the fourth quarter.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Under Armour (UAA) reported an adjusted earnings per share (EPS) of $0.12 in 4Q versus analysts’ expectations of a loss per share of $0.07. The company’s revenues declined 3% to $1.4 billion year-on-year, surpassing consensus estimates of $1.3 billion.

Under Armour’s CEO, Patrik Frisk said, “Improving brand strength and consistent operational execution delivered better than expected results in the fourth quarter. Our global team was exceptionally resilient and disciplined amid a highly challenging year which included the COVID-19 pandemic and for Under Armour, a comprehensive restructuring effort including further operating model refinements.”

Wholesale revenue declined 12% in 4Q to $662 million year-on-year. Against this, direct-to-consumer revenues climbed 11% year-on-year to $655 million, driven by 25% growth in e-commerce sales.

In FY21, the company expects sales to grow at a high single-digit percentage rate driven by a high single-digit growth rate in North America and a growth rate in the high-teens internationally. Operating income is forecasted to come to land between $5 million to $25 million. Adjusted diluted EPS is projected to generate between $0.12 to $0.14. (See Under Armour stock analysis on TipRanks)

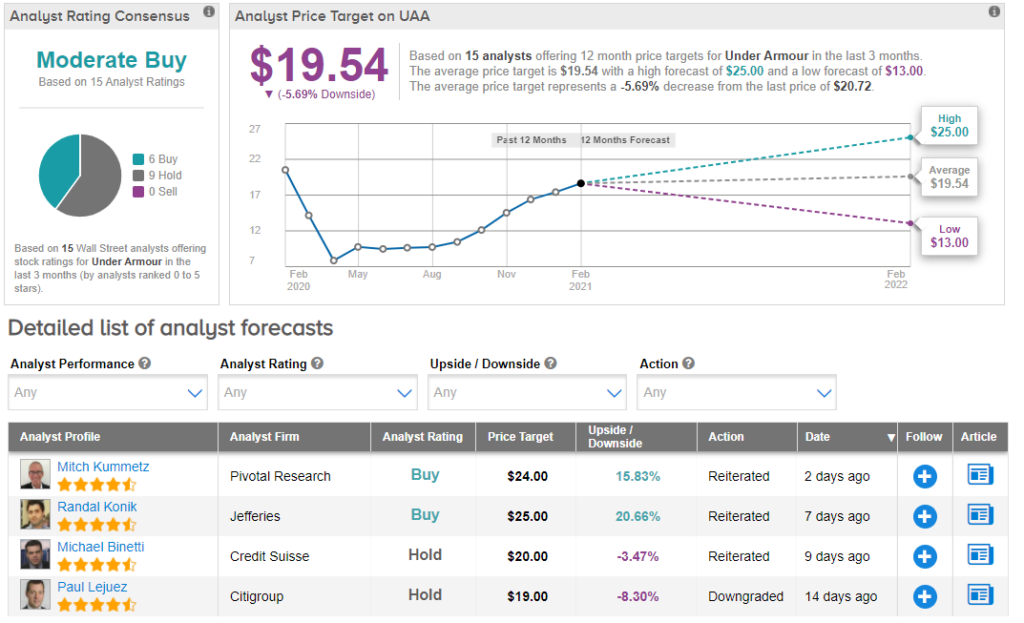

On Feb. 8, Pivotal Research analyst Mitch Kummetz reiterated a Buy rating and a price target of $24 on the stock. Kummetz noted that among the companies that had already announced their fourth quarter results “two things have stood out: stronger-than-expected holiday sales, and less-than anticipated promotional activity.”

The analyst noted that Pivotal’s “recent footwear surveys also confirm that the athletic trend remains robust, with fall/holiday reorders coming in nicely for the season. All told, we’re modeling 4Q slightly above the high end of UAA’s guidance, and we see room for potential upside to our estimates, especially on GM [gross margin]”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 6 analysts recommending a Buy and 9 analysts suggesting a Hold. The average analyst price target of $19.54 implies 5.7% downside potential to current levels.

Related News:

Twitter Quarterly Sales Outperform Driven By Ad Revenue; Shares Rise

Cisco Drops 4.6% Pre-Market On Flat Sales Growth In 2Q

Lyft Sees Recovery Path After 4Q Sales Outperform; Shares Spike 13%