Shares in Ulta Beauty (ULTA) spiked 14% in Thursday’s after-market trading session after the company delivered better-than-feared comparable sales.

Specifically, Q2 Non-GAAP EPS of $0.73 beat Street estimates by $0.58 while GAAP EPS of $0.14 also topped Street expectations by $0.04. However, revenue plunged 26.3% year-over-year, and missed consensus estimates by $10M.

Crucially, comparable sales of -26.7% came in better than the expected drop of -30.8%. During the second quarter, transactions declined 36.2% and average ticket increased 14.9%.

“While the pandemic continues to impact our business, we are encouraged by improving trends. Comparable sales trends improved significantly throughout the quarter, from decreasing 37% in early May, as we began reopening stores, to decreasing 10% in July, when most of our stores were re-opened” commented Ulta CEO Mary Dillon.

She continued: “Notably, sales trends have continued to improve, with comparable sales down in the mid-single digit range for the first three weeks of August.” As of 8/1, salon services were available in ~88% of stores.

Looking forward, management now expects ULTA to incur $35–40M in PPE and COVID-19-related costs in 2H20, and to open 30 new stores and five relocation projects vs. prior expectations for 30–40 new stores and three relocation projects. Capex is now expected to be $180–200M, down from $200–210M previously.

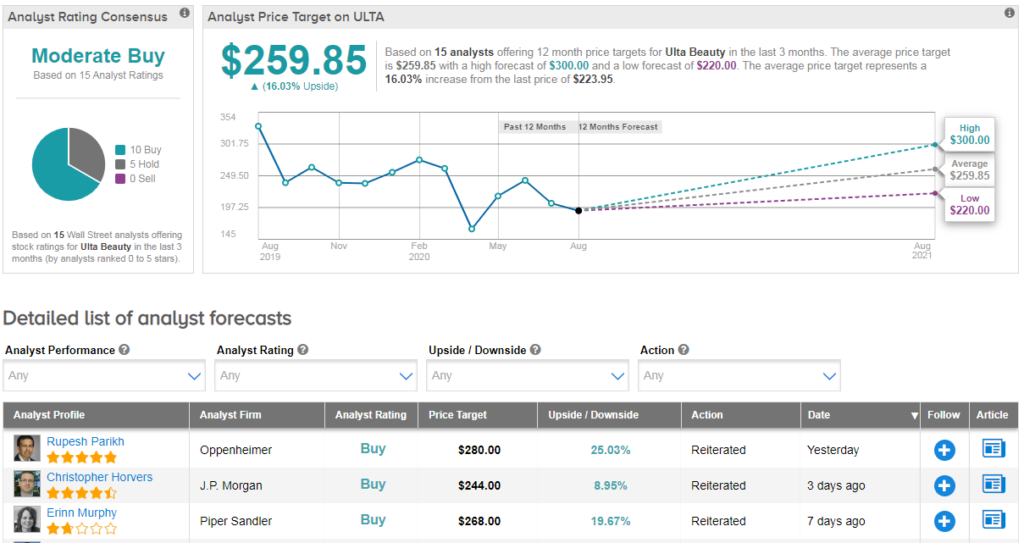

Following the results, Oppenheimer analyst Rupesh Parikh reiterated his Ulta buy rating with a $280 price target up from $270 previously.

“We overall view the Q2 results and, more importantly, the significantly improved Q3-to-date comp trends as much better than feared” he explained.

In particular, August to date, comps are down only in the mid-single-digit range even with services not at full capacity, major makeup category headwinds, and limited couponing efforts to drive traffic.

“Although encouraged by August trends, we still expect continued volatility from here given COVID-19-related risks. As a result, we would still take advantage of weakness and not chase strength” he concluded, adding “ULTA remains our favorite re-opening play.” (See ULTA stock analysis on TipRanks).

Overall, ULTA scores a cautiously optimistic Moderate Buy Street consensus, with 10 recent buy ratings and 5 hold ratings. Meanwhile the average analyst price target of $260 indicates 16% upside potential from current levels, with the stock down 11% YTD.

Related News:

Nordstrom Drops 5% Post-Print; Analyst Says Stock Fairly Valued

Kroger vs Costco: Which Retail Stock Is A Better Buy?

Box Beats 2Q Estimates Fueled By Cloud Storage Demand