Beauty retailer Ulta Beauty (ULTA) is scheduled to report its results for the third quarter of Fiscal 2024 after the market closes on December 5. Shares have declined nearly 20% year-to-date, as investors are concerned about the company’s unimpressive top-line growth due to increased competition and the impact of macro challenges on consumer spending. Analysts expect Ulta Beauty to report earnings per share (EPS) of $4.51 for Q3 FY24, reflecting an 11% year-over-year decline.

Further, Wall Street expects Q3 revenue to remain almost flat year-over-year at $2.49 billion. The top-line estimate reflects challenges that the company is facing, especially in the prestige beauty space, and the impact of inflation and high interest rates on discretionary spending.

Sentiment Ahead of Ulta Beauty’s Q3 Earnings

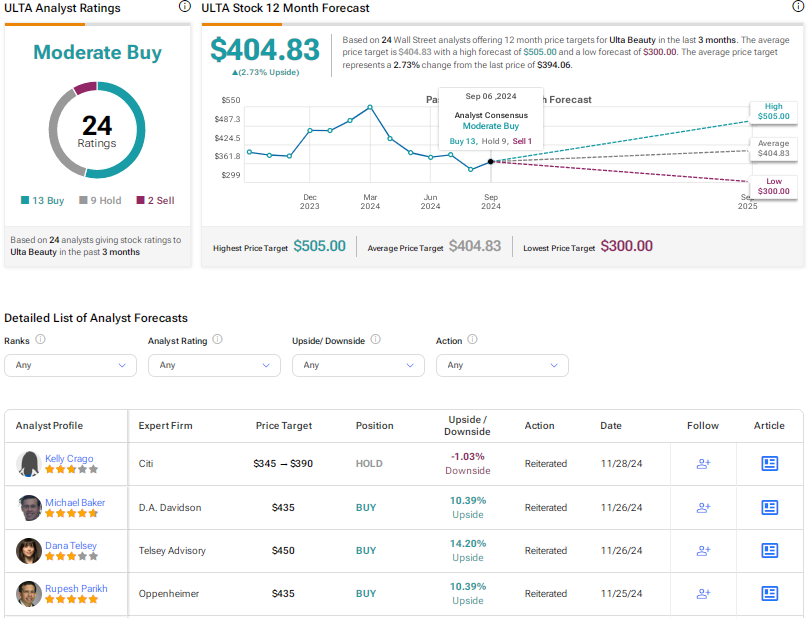

Heading into the Q3 print, Citi analyst Kelly Crago increased the price target for Ulta Beauty stock to $390 from $345, but maintained a Hold rating. The analyst expects the company to surpass Q3 EPS expectations, driven by better-than-expected comparable sales and a modest improvement in gross margin.

That said, Crago noted that ULTA is under pressure due to weakening category trends and intense competition that is making it difficult to boost traffic. The analyst highlighted that industry trends have neither improved nor deteriorated in Q3 FY24 compared to the second quarter, suggesting that management might narrow their full-year EPS guidance range. Nonetheless, Crago thinks that the stabilization of comparable sales trends is a slightly positive sign, as it indicates more confidence in ULTA achieving its FY25 targets.

Meanwhile, William Blair analyst Dylan Carden downgraded Ulta Beauty stock from Buy to Hold. The analyst thinks that the company’s expectations and the Street’s 2025 comparable sales and operating margin estimates still look too optimistic and indicate an early 2025 inflection in the beauty space, which he contends is unlikely.

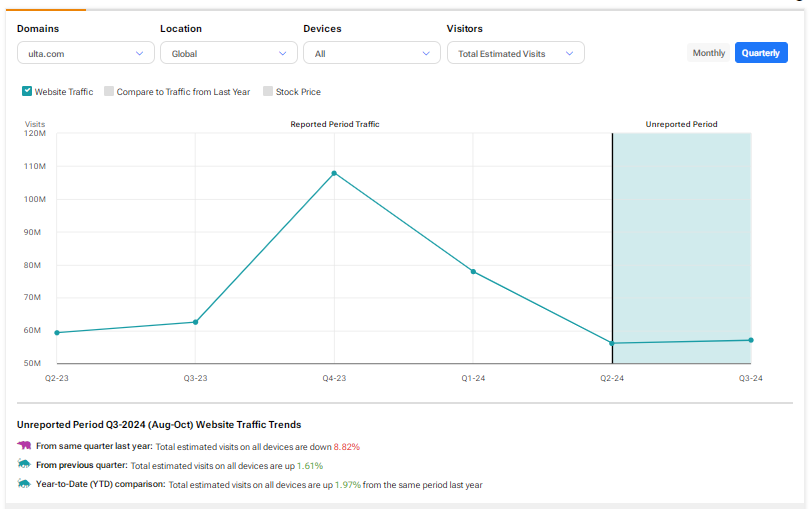

Website Traffic Reflects Headwinds

Ulta Beauty’s online sales reflect the ongoing headwinds the company is facing. As per TipRanks’ Website Traffic Tool, visits on ulta.com declined about 9% year-over-year in Q3 FY24 and increased by a modest 1.6% compared to the second quarter. These numbers indicate that macro pressures and competition continue to weigh on the company’s top line.

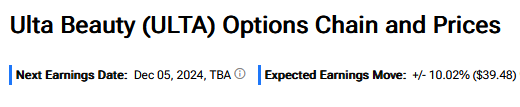

Options Traders Anticipate a Major Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting about a 10% swing in either direction in ULTA stock.

Is Ulta Beauty Stock a Good Buy Now?

Wall Street is cautiously optimistic about Ulta Beauty stock, with a Moderate Buy consensus rating based on 13 Buys, nine Holds, and two Sells. The average ULTA stock price target of $404.83 implies a modest 2.7% upside potential.