In major news on UK stocks, energy giant Shell (NYSE:SHEL) (GB:SHEL) released its Q1 2024 results, with profits significantly beating expectations. Shell reported adjusted earnings of $7.7 billion in the first quarter of 2024, compared to analysts’ estimates of $6.5 billion. The Q1 2024 income was supported by reduced group operating costs and increased margins from trading and refining. Additionally, Shell revealed a $3.5 billion share buyback program, which is anticipated to be completed over the next three months. Shell’s UK-listed shares were trading up by 1% as of writing.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Shell is a leading oil and gas company that provides a wide range of energy products, including fuels, oil, liquefied petroleum gas (LPG), and lubricants.

Let’s take a look at more details.

Shell’s Performance in Q1 2024

Despite surpassing forecasts, Shell’s earnings were down nearly 20% compared to Q1 2023, largely due to an industry-wide trend. The world’s leading oil and gas companies reported record profits in 2022 and 2023, following Russia’s full-scale invasion of Ukraine. However, more recently, revenues have been impacted by plummeting gas prices.

Within its divisions, Shell’s Chemicals and Products segment, which includes refining and oil trading, saw a substantial rise in adjusted EBITDA compared to the previous quarter, reaching $2.8 billion.

However, these numbers were offset by weaker performance from its flagship LNG (liquefied natural gas) trading business compared to the previous quarter, as well as unfavourable tax movements. Shell’s Q1 2024 LNG production increased by 7% compared to the previous quarter, reaching 7.58 million metric tons. However, sales volumes declined by about 7% to 16.9 million tons.

During the first quarter, Shell generated $9.8 billion of free cash flow, an increase from $6.9 billion in the preceding period, while net debt decreased to $40.5 billion from $43.5 billion in Q4 2023.

Is Shell Stock a Good Buy Now?

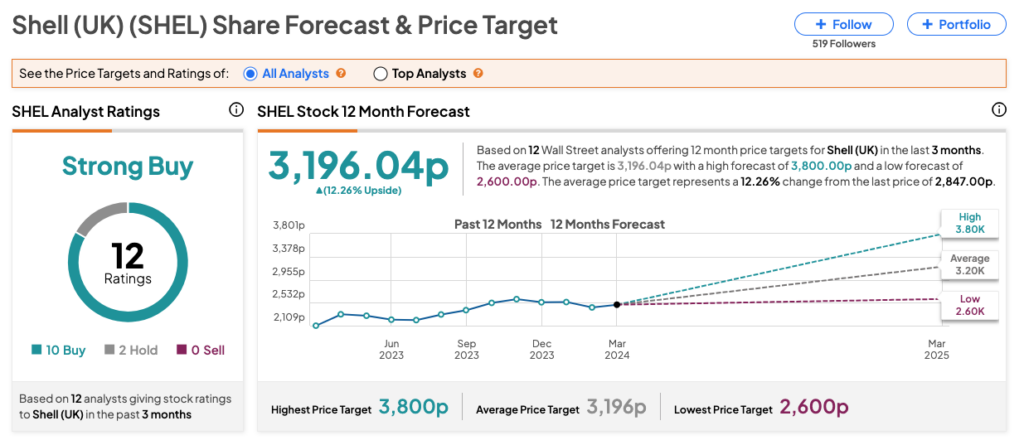

Overall, analysts have a bullish stance on SHEL stock, reflected in the Strong Buy rating on TipRanks. This is based on 10 Buy and two Hold recommendations. The Shell share price target of 3,196.04p implies a 12.3% increase on the current price level.