Robotic process automation company UiPath, Inc. (PATH) delivered better-than-expected third-quarter results, with both earnings and revenue exceeding estimates. The company even guided for the fourth quarter, exceeding consensus estimates.

However, following the news, shares spiked up 1% momentarily, before closing down 3.7% during the extended trading session on December 8.

Better-Than-Expected Results

The company’s Non-GAAP earnings broke even, exceeding analysts’ estimates of a quarterly loss of 4 cents per share. In the prior-year quarter, the company posted a quarterly loss of 4 cents per share.

Furthermore, revenue climbed 50% year-over-year to $220.82 million, surpassing analysts’ estimates of $208.63 million.

Compared to Q3FY21, UiPath’s annual recurring revenue (ARR) grew 58% with the addition of $91.9 million of net new ARR during the quarter.

Management Comments

UiPath Co-Founder and CEO, Daniel Dines, said, “Our continued growth at scale was driven by customers across verticals and geographies who recognize that the power of automation not only increases efficiency but also drives revenue growth and creates a significant competitive advantage.”

UiPath CFO, Ashim Gupta, said, “Looking ahead, we expect that the innovation we are delivering in UiPath 2021.10, our most recent platform release, coupled with investments in our teams and strategic partnerships will further accelerate customer success and platform adoption. Our focus continues to be on driving long-term, durable growth as we believe that we have the unique opportunity to build a truly multigenerational company.”

Guidance

Based on the current economic environment and business momentum, UiPath forecasts fourth-quarter revenue to fall in the range of $281 million to $283 million, while the consensus estimate is pegged at $281.1 million. Additionally, Q4 ARR is projected to be between $901 million to $903 million.

See Analysts’ Top Stocks on TipRanks >>

Wall Street View

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 6 Buys and 5 Holds. The average UiPath price target of $70.80 implies 48.4% upside potential to current levels. However, shares have lost 30.6% over the past six months.

Blogger Opinion

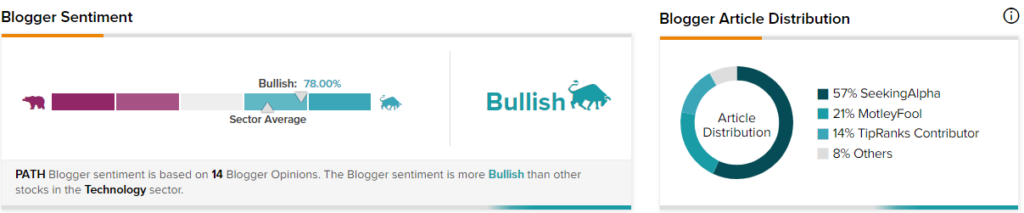

According to TipRanks data, financial blogger opinions are 78% Bullish on PATH, compared to a sector average of 68%.

Related News:

BuzzFeed Stock Loses 29% Since Listing

AutoZone Surges 7.6% on Solid Q1 Beat

Casey’s Falls 3.5% on Missed Q2 Earnings

Questions or Comments about the article? Write to editor@tipranks.com