Streaming giant Netflix (NFLX) has been making headway into live sports with Christmas Day NFL football games scheduled. But now, Netflix may have a whole new target in mind: UFC fights.

In 2025, UFC media rights will be up for renewal. And the group’s chief operating officer, Mark Shapiro, thinks that Netflix could be coming around looking to make a bid for it. We do know that Netflix already has a WWE wrestling connection, but that may be under a bit of stress.

Netflix is taking down its Undertaker special—Escape the Undertaker—which was an interactive title that featured New Day wrestlers trying to flee from wrestler The Undertaker. Netflix noted that there were no more interactive titles being worked on, and all but four of the 24 currently available are being removed.

A Budget Snub

Oddly enough, Netflix’s hopes of landing a major project from Margot Robbie have apparently been dashed by a lesser offer from a competitor. Netflix offered $150 million to buy the rights to a new Wuthering Heights adaptation featuring Robbie and Jacob Elordi. But Netflix was rebuffed, and instead, Warner Bros Discovery (WBD) got the nod, despite offering only $80 million.

However, Warner did offer a “…wide theatrical release and full marketing campaign,” which Netflix probably could not have matched. It may be one of the big disadvantages of being a streaming pure-play in a time when the movie theater still exists. In fact, reports suggests that Netflix does not even try for theatrical releases with most of its projects.

Is Netflix Stock a Good Buy?

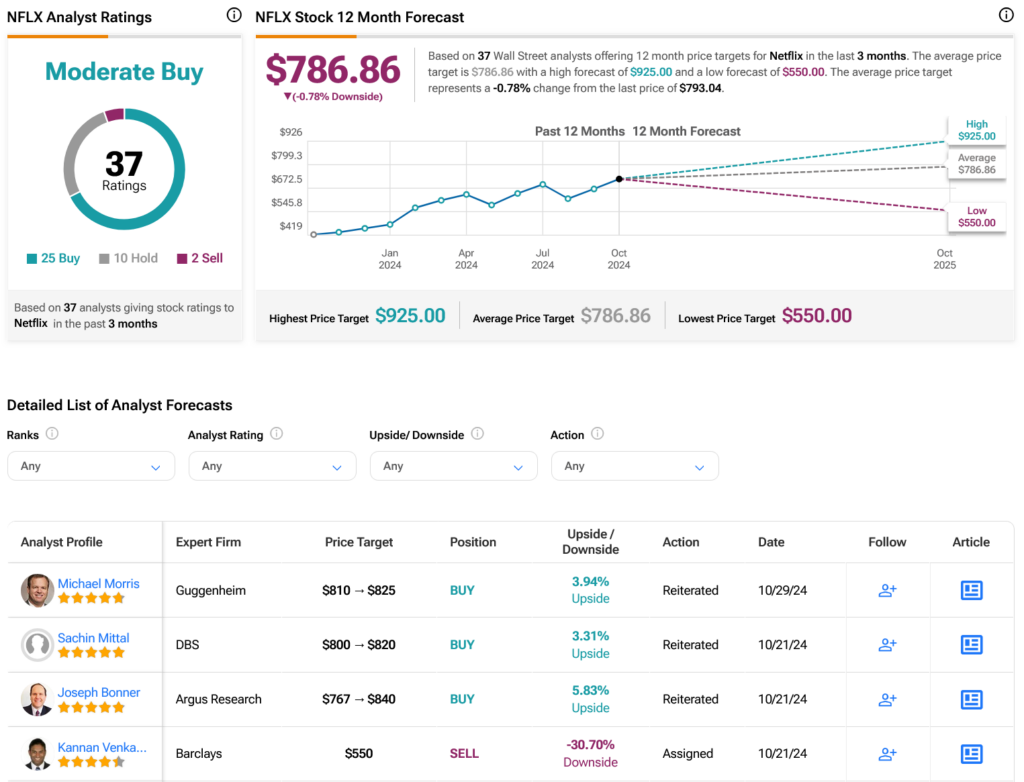

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 25 Buys, 10 Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 81.77% rally in its share price over the past year, the average NFLX price target of $786.86 per share implies 0.78% downside risk.