Shares of Dutch Bros (BROS) surged in today’s trading after UBS upgraded the coffee shop chain from Hold to Buy. The firm noted that new store performance is improving and that there are good reasons to expect higher same-store sales. As a result, UBS set a price target of $39 per share.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Four-star analyst Dennis Geiger thinks the stock is set to rise as same-store sales get stronger into 2025, with new store growth expected to stay solid next year. He sees the current valuation as a good buying opportunity as it matches up with the company’s expected 20%+ growth in revenue and EBITDA.

Geiger also thinks the company’s 2024 same-store sales forecast is cautious, especially since it doesn’t include the benefits of mobile ordering, which should be in most stores by the end of 2024. This feature, along with gains in digital and loyalty programs, new menu items, and marketing, is expected to drive more traffic and boost sales in 2025.

It’s worth noting that, so far, Geiger has enjoyed a 57% success rate on his ratings, with an average return of 5.8% per rating.

Is BROS Stock a Buy or Sell?

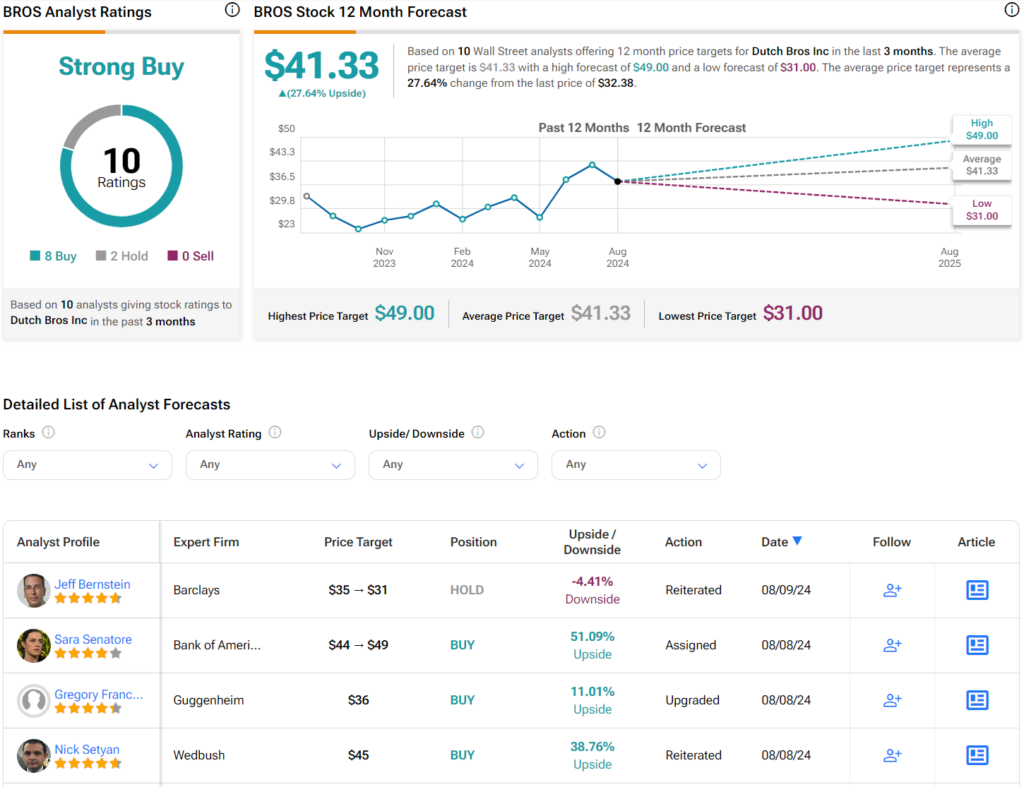

Turning to Wall Street, analysts have a Strong Buy consensus rating on BROS stock based on eight Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 4% rally in its share price over the past year, the average BROS price target of $41.33 per share implies 27.64% upside potential.