Uber Technologies Inc.’s (UBER) latest stock offer for rival food delivery company GrubHub Inc. (GRUB) is said to have been rejected as merger talks continued over the weekend.

The Wall Street Journal reported that talks between Grubhub Chief Executive Officer Matt Maloney and Uber CEO Dara Khosrowshahi on Sunday indicated that Uber’s latest offer of 1.9 of its shares for each GrubHub share is too low. Khosrowshahi said he might see room to bump up the offer to 1.925 Uber shares. However, that is still well below the price GrubHub had been seeking, the report said.

Discussions are still ongoing with an agreement unlikely in the next few days, according to the report. Once an accord is struck, regulators would still need to approve the merger at a time when the coronavirus pandemic is creating a lot of uncertainty and operations are still disrupted.

Shares in both Uber and GrubHub are advancing in Monday’s pre-market trading. In the run-up to the merger talks, Uber soared 15% over the past month trading at $32.47 as of Friday, while GrubHub surged 29% to $54.97 during the same period. Both companies have been benefiting from an increase in food delivery demand during lockdown orders tied to the coronavirus pandemic.

Wedbush analyst Ygal Arounian estimated that a merger between Uber Eats and GrubHub would give the combined company a 55% market share in the food delivery market and as such would turn it into a clear leader in the space.

That would be “the first time since 4Q17 that a single player controlled more than 50% of the market”, he said, while maintaining his Buy rating on Uber stock with a $38 price target.

“While each have respective market strengths, the overlap in diners, restaurants, and markets should create significant cost-saving opportunities, particularly in sales and marketing expenses, but also in technology, and headcount, which can go a long way in alleviating the gross margin pressure driven by the actual cost to deliver meals,” Arounian wrote in a note to investors.

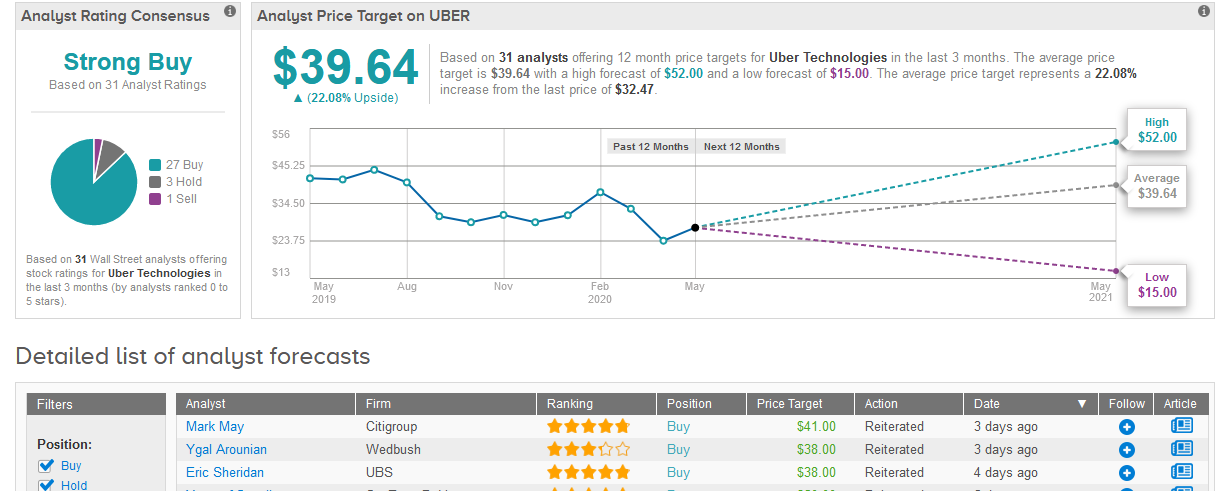

Overall, Wall Street analysts have a bullish outlook on Uber’s stock boasting 27 Buys, 3 Holds and 1 Sell that add up to a Strong Buy consensus. The $39.64 average price target projects shares have room to increase 22% in the coming 12 months. (See Uber’s stock analysis on TipRanks)

Five-star analyst Brian Nowak at Morgan Stanley, who raised GrubHub’s price target to $49 from $46, said he estimated that a GrubHub-Uber tie-up could generate $650 million in potential cost savings in 2021. Nowak reiterated his Hold rating on the stock.

Nowak added that he would not be surprised to see GrubHub shares trade between his $49 base scenario price target and his $76 “bull case” target based on the rumored bid price and perceived probability of any deal closing.

Related News:

Uber Announces $750M Notes Offering, As GrubHub Takeover Reports Swirl

Uber Puts Hopes on Food Delivery Momentum After $2.9 Billion Loss

AMC Pops 11% Amid Potential Acquisition Talks by Amazon