Uber Technologies posted its highest monthly gross bookings in its twelve-year history in March, according to an SEC filing reported on Monday. The company’s Mobility business crossed the $30 billion annualized gross bookings run-rate and had its best month since March last year.

Uber’s (UBER) mobility business recorded average daily gross bookings that were up by 9% on a month-over-month basis. Uber’s food delivery business, Uber Eats, crossed the $52 billion gross bookings run-rate in March on an annualized basis, rising more than 150% year-on-year.

Uber stated in the filing, “As vaccination rates increase in the United States, we are observing that consumer demand for Mobility is recovering faster than driver availability, and consumer demand for Delivery continues to exceed courier availability.”

Earlier this month, the company also said that it was increasingly investing in driver incentives to improve the availability of drivers in the near-term.

In March, Uber said that effective March 17, ride-hailing drivers in the United Kingdom using UBER’s mobility platform will be treated as workers. As a result, the company has started a claims settlement process for drivers in the UK.

Subsequently, the company expects to incur significant costs related to these claims settlement and other related costs in 1Q FY21. These costs are likely to drag down the company’s total revenues, revenues for its Mobility business and revenue take rates, but will not impact the company’s adjusted EBITDA in the fiscal first quarter.

In February this year, UBER suffered a blow when UK’s Supreme Court ruled that a group of the ride-hailing company’s drivers are entitled to worker rights, including a minimum wage. According to a Reuters report, a total of 25 Uber drivers were part of the case.

These drivers were previously considered self-employed. As a result, they were entitled to only minimal protection by law in the UK – a status that Uber had sought to maintain in the legal tussle. (See Uber Technologies stock analysis on TipRanks)

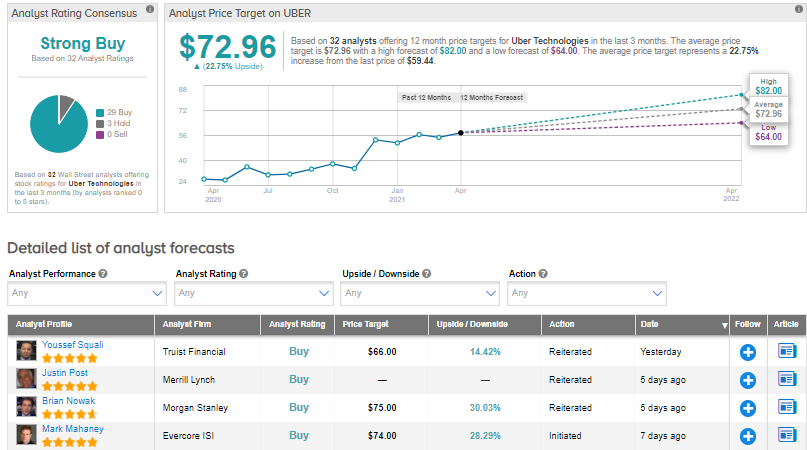

Following the business update from UBER, Truist Financial analyst Youssef Squali reiterated a Buy rating and a price target of $66 on the stock. Squali viewed the business update as “incrementally positive” and said that this bodes well for UBER’s fiscal outlook for the first quarter and FY21.

Shares of UBER have gained 112.4% in the past year.

Overall, the rest of the Street is bullish on the stock in line with Squali’s view with a Strong Buy consensus rating based on 29 Buys and 3 Holds. The average analyst price target of $72.96 implies that UBER shares have approximately 22.8% upside potential to current levels.

Related News:

Iovance Gives Clinical Data Update For Melanoma Drug

Sanofi Snaps Up Tidal Therapeutics For $160M

Sorrento’s Subsidiary Scilex Gets FDA Nod For ZTlido Label Expansion