Uber (UBER) and SK Telecom are teaming up on a new joint venture to “create opportunities in the taxi-hailing market in Korea and explore new areas, including future mobility services.”

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The joint venture will combine SK Telecom’s T Map Mobility’s network of drivers and mapping technology with Uber’s ride hailing technology and global operations expertise.

Uber will invest over $100 million in the joint venture- and will invest a further $50 million in T Map Mobility. Reuters reports that Uber will own 51% of the joint venture, while SK Telecom will hold 49%.

Subject to the satisfaction of customary closing conditions, including regulatory approval, the joint venture is expected to begin operations, and Uber is expected to invest in T Map Mobility, in the first half of 2021.

“Korea was one of Uber’s first international markets, and we are committed to fully realizing its potential. Through our strong partnership with SKT, we will expand access to ride hailing services in the country, and bring better service to riders and drivers. We look forward to serving the South Korean market in the years ahead,” said Nelson Chai, CFO of Uber.

Meanwhile Park Jung-ho, CEO of SKT, added: “We will work closely with companies with diverse capabilities to address current challenges in transportation, and ultimately usher in a new era of future mobility technologies such as flying cars.”

SK Telecom also announced plans to launch T Map Mobility within this year by splitting off its Mobility Business Unit, which is in charge of services including T Map and T Map Taxi.

T Map is the largest mobility platform in Korea with around 13 million monthly active users, and T Map Taxi is the nation’s second largest taxi hailing service with 200,000 registered drivers and 750,000 monthly active users. It also provides other mobility services such as T Map Auto, T Map Public Transportation and T Map Parking.

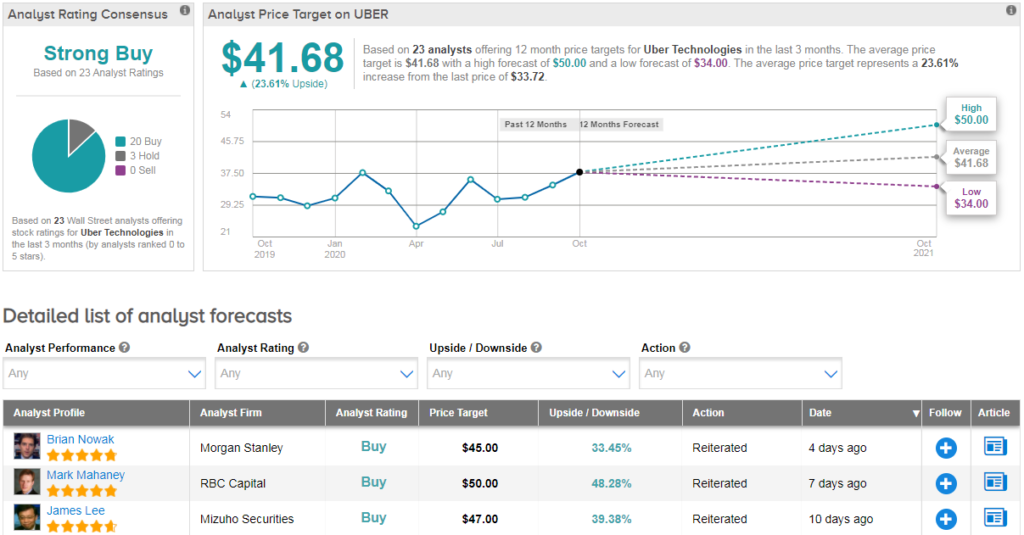

Currently, the Street has a bullish outlook on Uber. The Strong Buy analyst consensus is based on 20 Buys and 3 Holds. With shares up 13% year-to-date, the average price target of $42 implies a further upside potential of about 24% to current levels.

“We continue to be patiently long Uber and Lyft, given our belief that a) ridesharing will eventually return to pre-COVID levels and b) these two stocks carry substantial re-rating opportunities given long-term fundamentals” comments RBC Capital’s Mark Mahaney. He has a buy rating on Uber and Street-high $50 price target (48% upside potential).

According to the analyst, Uber trades at a material discount to the peer group median, at less than half the level of relevant comps, which he believes creates a potentially very compelling valuation opportunity. (See UBER stock analysis on TipRanks)

Related News:

Ford China Sales Rise Two Quarters In A Row, Jump 25% Y/Y

Cars.com Soars 26% On Strong 3Q Sales Outlook, Analyst Upgrade

Raytheon Scores $239M US Air Force Contract Modification