Uber Technologies (UBER) reported mixed results for the third quarter. The mobility services provider missed earnings estimates, but surpassed revenue estimates.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Revenue & Earnings

Uber reported quarterly revenues of $4.8 billion, reflecting a 72% year-over-year growth, exceeding the consensus estimate $4.43 billion. All major revenue segments witnessed growth. Notably, Delivery revenues and Mobility revenues experienced the sharpest year-over-year growth of 97% and 62% to $2.24 billion and $2.20 billion, respectively.

However, the company reported a quarterly loss of $1.28 per share, wider than the loss of $0.62 per share in the previous year and the consensus estimate of a loss of $0.34 per share.

Other Operating Metrics

The company’s Gross Bookings increased 57% from the previous year to $23.1 billion, with Mobility Gross Bookings and Delivery Gross Bookings rising 67% and 50%, respectively, over the same quarter last year.

Notably, the number of trips also increased from last year by 39% to 1.64 billion.

Similarly, Monthly Active Platform Consumers witnessed a year-over-year growth of 40% and stood at 109 million at the end of the quarter.

Outlook

In the fourth quarter, the company expects Gross Bookings to be between $25 billion and $26 billion, and adjusted EBITDA to be in the range of $25 million to $75 million.

Management Commentary

Uber CEO Dara Khosrowshahi said, “Our early and decisive investments in driver growth are still paying dividends, with drivers steadily returning to the platform, leading to further improvement in the consumer experience.”

See Top Smart Score Stocks on TipRanks >>

Price Target

On November 3, Bank of America Securities analyst Justin Post reiterated a Buy rating on the stock, with a price target of $64, which implies upside potential of 41.4% from current levels.

According to the analyst, positive ride trends, controlled expenses and increases in driver supply will act as tailwinds for the company.

The analyst stated, “We think Uber should benefit from similar profitability tailwinds as mobility rebounds and driver supply improves in 2022, demonstrating fixed cost leverage and improving take rates. We continue to see Uber as the top Internet stock in our coverage for improving labor supply conditions, and we maintain our Buy rating.”

Consensus among analysts is a Strong Buy based on 17 Buys and two Holds. The average Uber price target of $67.68 implies upside potential of 49.5% from current levels. Shares have gained 0.9% over the past year.

TipRanks Website Traffic

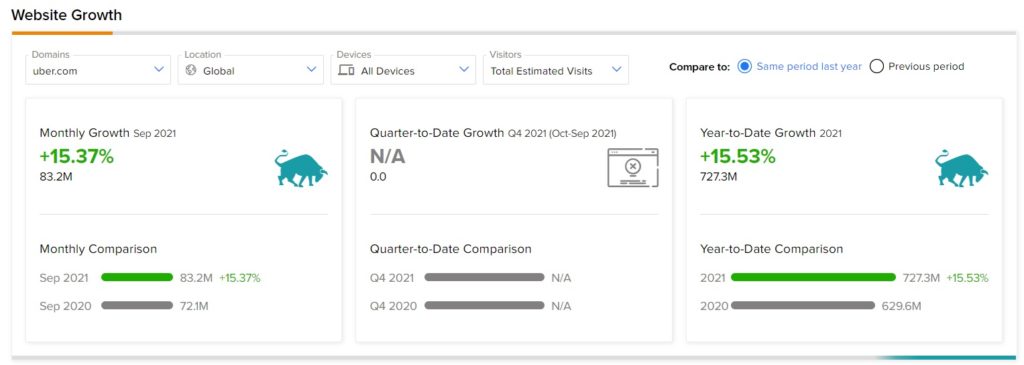

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Uber’s performance this quarter.

According to the tool, the Uber website recorded a 15.4% monthly rise in global visits in September. Further, year-to-date, website traffic rose 15.5%.

Related News:

Qualcomm Posts a Blowout Quarter; Shares Jump 7.5%

Roku’s Q3 Revenues & Q4 Outlook Disappoint

BCE Q3 Revenues, Profit Rise