Does anyone else hear the sound of a canary in a coal mine? Because that’s what it sounds like from here when ride-sharing kingpin Uber’s (NASDAQ:UBER) former CFO dumped $4.5 million in stock on his way out the door. The market didn’t take it unkindly, sending Uber up nearly 2% in the closing minutes of Wednesday afternoon’s trading, but it certainly raised some eyebrows.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Earlier this week, Nelson Chai, Uber’s former CFO, departed on less than an upbeat note when he sold off 100,000 shares of Uber valued at roughly $4.5 million. That wasn’t all the Uber stock that Chai held; at last report, he still had about 292,000 shares left. And despite this sale, one of the last things that Chai had to say about Uber was that it was “…well positioned to drive tremendous value for shareholders in the coming years.” That begs the question: If that is the case, then why did Chai sell off roughly a quarter of his total holdings therein?

While that question may not be answered for at least a few years to come, one question—how Uber will drive that value—is a bit clearer. Recently, Uber shifted its pricing model from the current “surge pricing” model to something a little different. Surge pricing essentially occurs when there are too many riders for available drivers, and prices go up to get more drivers to tap in for the higher rates. Recently, Uber—and other ride-hailing operations as well—started shifting to offer two sets of prices: one price to the rider and one rate to the driver. If there was a difference, Uber would quietly pocket the difference, reports noted.

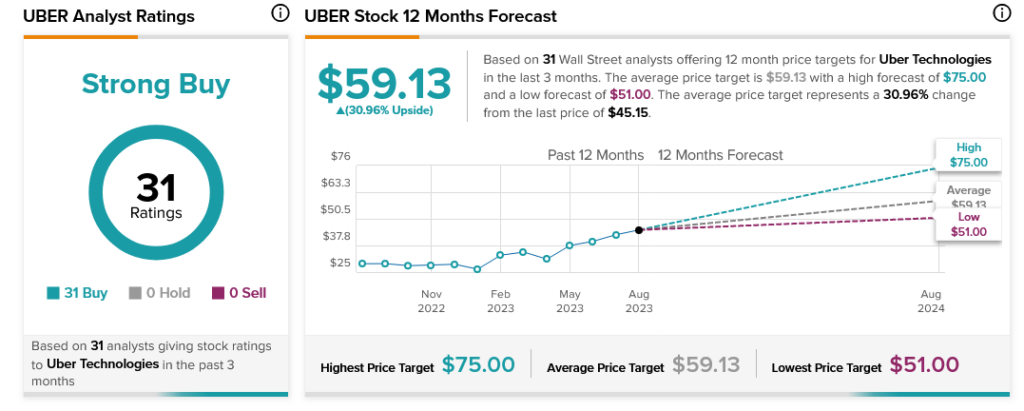

Analysts, meanwhile, are all in favor of Uber in general. With 31 Buy ratings, Uber stock is, unanimously, a Strong Buy. Further, with an average price target of $59.13, Uber stock also comes with 31.01% upside potential.