Shares of Uber (NYSE:UBER) and Lyft (NASDAQ:LYFT) are trading lower today following an analyst report. Indeed, financial firm Nomura, led by Anindya Das, downgraded the ridesharing companies but for different reasons.

Lyft’s downgrade to Sell from Hold reflects tough business conditions and a less optimistic future, while Uber, despite holding its lead, might see more restrained growth in its share price. Nomura doubts any significant shifts in Lyft’s business that could outdo Uber’s strong market presence. As for Uber, although it was downgraded to Hold, it was still recognized for profitably scaling its business and solidifying its market position. Nomura assigned a $62 price target for Uber and a $13 price target for Lyft.

2023 turned out to be a stellar year for both companies. Nevertheless, UBER stock left LYFT in the dust with a whopping 149% surge in its share price, overshadowing Lyft’s 35% climb.

Is Uber or Lyft a Better Stock?

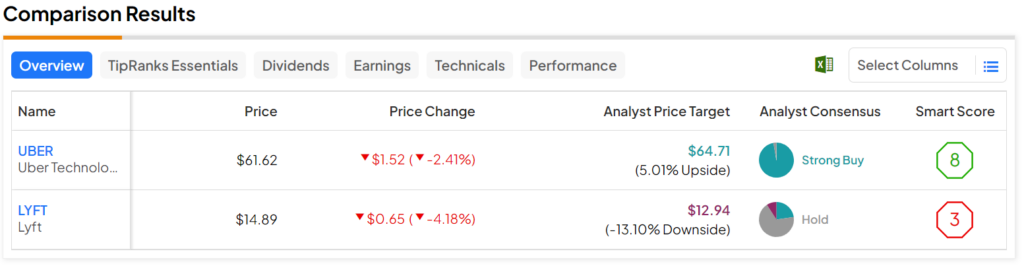

Overall, Wall Street analysts prefer Uber stock over Lyft. In fact, Uber has a Strong Buy consensus rating while Lyft is rated as a Hold. In addition, Uber’s price target of $64.71 per share implies 5% upside potential, whereas Lyft’s $12.94 price target equates to a 13.1% decline.