Ride-hailing companies Uber Technologies (NYSE:UBER) and Lyft (NASDAQ:LYFT) have settled a multi-year lawsuit in Massachusetts about the employment status of their drivers. So far, the companies have classified these drivers as independent contractors, denying them basic rights, such as minimum wages and union rights.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Settlement Terms

According to the deal, the companies will continue to classify drivers as independent contractors, but the minimum pay will be raised to $32.50 per hour. Further, the drivers will also get paid sick leave, accident insurance, and healthcare stipends.

Moreover, Uber and Lyft are expected to pay $148 million and $27 million, respectively, to Massachusetts for violating wage and hour laws. These funds will compensate affected current and former drivers.

A Similar Case in the Past

In 2023, both Uber and Lyft agreed to settle the New York attorney general’s allegations that they underpaid drivers.

The companies agreed to pay minimum wages and improve working conditions for drivers. Further, both Lyft and Uber paid $328 million to resolve the issue.

UBER and LYFT Risk Analysis

Based on the data from TipRanks’ Risk Analysis tool, UBER’s legal and regulatory risk exposure is significantly higher than Lyft’s.

Uber’s legal and regulatory risks account for 25% of its total risks, higher than the industry average of 20.3%. On the other hand, Lyft’s legal and regulatory risks account for only 13% of its total risks and remain much below the industry’s average.

Now, let’s take a look at what Wall Street analysts think about these stocks.

Is UBER a Buy or Sell Right Now?

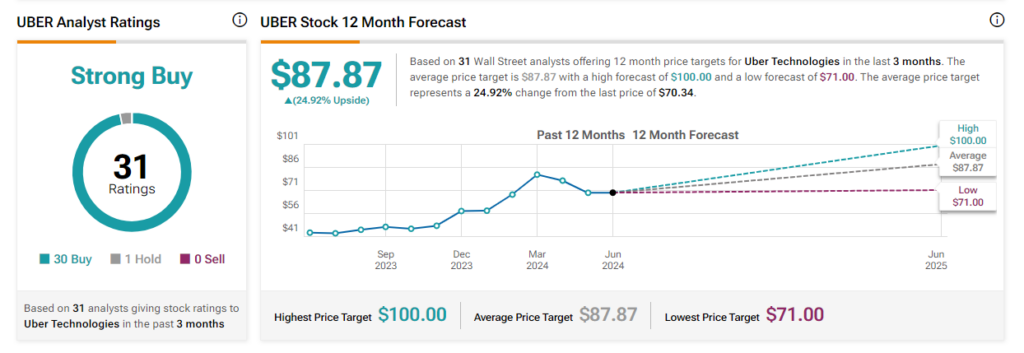

Analysts are optimistic about Uber’s prospects. It has a Strong Buy consensus rating based on 30 Buy and one Hold recommendations. The analysts’ average price target on UBER stock is $87.87, implying about 24.9% upside potential from current levels. Year-to-date, shares have gained 14.2%.

Is Lyft Stock a Buy Now?

Wall Street is cautiously optimistic about LYFT’s prospects. LYFT has a Moderate Buy consensus rating based on eight Buy and 21 Hold recommendations. The analysts’ average price target on Lyft stock is $19.38, implying 44.7% upside potential from current levels. Shares of the company are down 10.7% so far in 2024.