Uber Technologies Inc. (UBER) has entered into a partnership agreement with MoneyGram International (MGI), which will provide drivers and delivery couriers with a discount on online money transfers.

Shares in MoneyGram surged 10% to $2.12 on the news as of Tuesday’s close. Under the terms of the partnership, all workers on Uber’s platform, including the Driver app, Uber Eats, Uber Freight and Uber Works, are eligible for the discount on money transfers sent to family and friends in over 200 countries. The partnership has now been rolled out in the U.S., Canada, Australia, and the U.K.

“The spread of COVID-19 has been hard for everyone, and it has been particularly challenging for people who drive and deliver with companies like ours,” said an Uber spokesperson. “To help those who are supporting loved ones abroad during these uncertain times, we’re excited to partner with MoneyGram.”

Shares in Uber declined 0.7% to $34.56 after the ride-hailing company’s stock value more than doubled over the past two months.

Turning now to the outlook on the Street, the majority of analysts remain bullish on Uber stock as the company announced $1 billion in cost-cutting measures and is also focusing on ramping up its food delivery business. The demand for the service has been offsetting weak rides demand during the coronavirus pandemic.

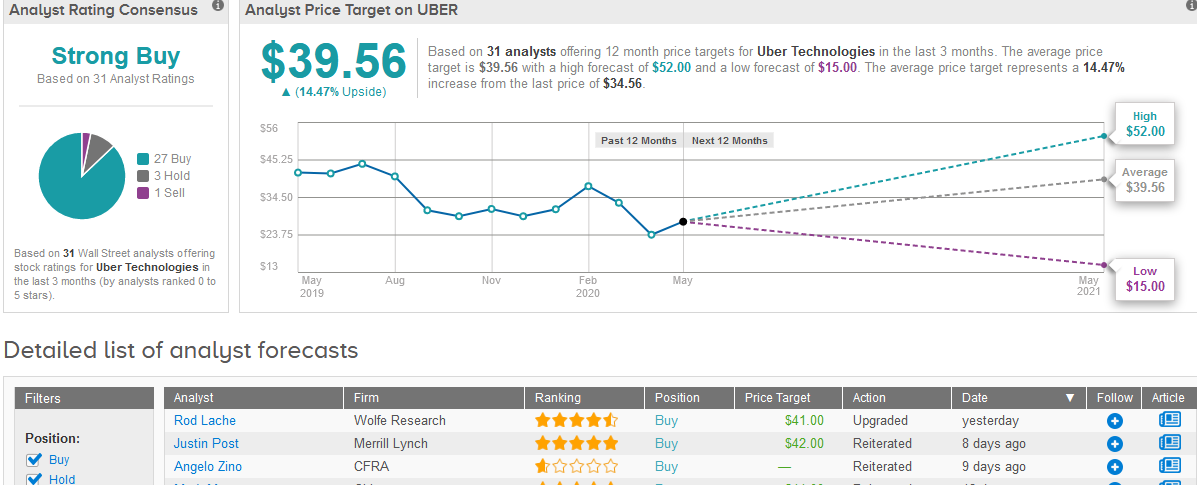

The strategy move gave five-star analyst Rod Lache at Wolfe Research on Monday enough reason for raising the stock to Buy from Hold and ramping up the price target to $41 from $36.

The analyst now believes that Covid-19 has pulled forward both growth in the Eats delivery segment and a necessary re-sizing of the cost structure, which has “meaningfully de-risked expectations for rides growth”.

TipRanks data shows that Uber stock boasts 27 Buys, 3 Holds and 1 Sell that add up to a Strong Buy consensus. The $39.56 average price target implies shares have room to rise another 15% in the coming 12 months. (See Uber’s stock analysis on TipRanks).

Related News:

Uber’s Latest Takeover Offer Said To be Rejected By GrubHub

Weight Watchers Fires Thousands Over Zoom

Facebook Workplace Hits 5 Million Paid Users As Remote Work Demand Rises