Uber Technologies has been fined $59 million for “refusing” to provide the California Public Utilities Commission (CPUC) with information regarding sexual assault and sexual harassment claims.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The CPUC determined that if Uber (UBER) fails to pay the penalty within 30 days, its permits to operate as a transportation network company (TNC) and a charter-party carrier will be suspended.

The claims relate to rulings dated December 19, 2019 and January 27, 2020, which required Uber to provide information regarding sexual assault and sexual harassment allegations arising out of the ride-hailing company’s California transportation network company passenger services.

“Commission staff has investigated complaints against TNC drivers, particularly those that alleged that drivers have behaved in a manner that has endangered the TNC passenger and other members of the driving and riding public,” it was stated in the ruling. “Without giving the Commission access to the information regarding the sexual assault and sexual harassment claims, the Commission is not in a position to investigate these claims with Uber and determine if Uber needs to implement additional measures to protect its passengers and drivers.”

Last year’s ruling had ordered Uber to provide answers to questions related to its US safety report presented in 2019, which detailed mainly motor vehicle fatalities, fatal physical assaults, and sexual assault and sexual harassment claims that occurred in 2017, 2018, and 2019, while using its ride-hailing services.

“The CPUC has been insistent in its demands that we release the full names and contact information of sexual assault survivors without their consent,” Uber said in a statement. “We opposed this shocking violation of privacy, alongside many victims’ rights advocates.”

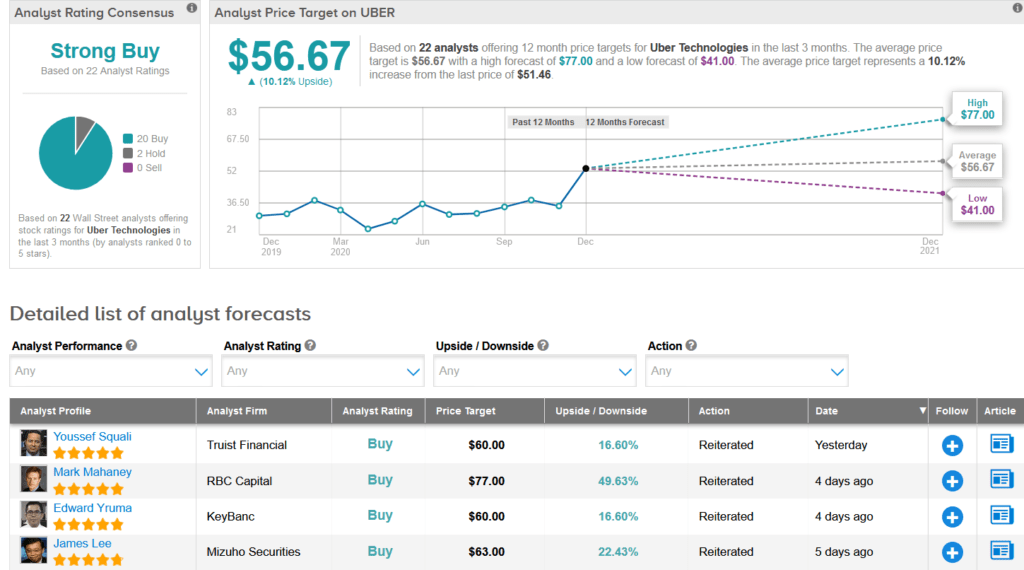

Meanwhile, Truist analyst Youssef Squali lifted the stock’s price target to $60 (17% upside potential) from $53 and reiterated a Buy rating, as he is confident that Uber’s recent deal moves put the company on the right track to achieve its profitability target.

Squali argued that the earlier-than-expected closing of the Postmates deal and the sale of ATG to Aurora will help boost the company’s timeline for profitability in FY21.

Specifically, the analyst believes that the Postmates acquisition has synergistic opportunities for Uber as it helps the company gain market share in particular markets for its Eats delivery business. Additionally, the ATG divestment removes an “expensive initiative” from Uber’s balance sheet, he commented. (See UBER stock analysis on TipRanks)

The rest of the Street is firmly in line with Squali’s bullish outlook. The Strong Buy analyst consensus boasts 20 Buys vs. 2 Holds. With shares up a stellar 73% year-to-date, the average price target of $56.67 implies upside potential of another 10% to current levels.

Related News:

KKR Nabs Industrial Properties Portfolio For $835M; Stock Up 36% YTD

Huntington, TCF Financial To Merge In $22B Deal; Shares Gain 5%

EA To Buy Codemasters For $1.2B; Street Is Cautiously Optimistic