U.S. Steel (X) stock jumped 9.5% on Tuesday, as Japan’s Nippon Steel (JP:5401) reportedly offered the U.S. government veto power over any potential reductions to U.S. Steel’s production capacity in an attempt to secure approval for its proposed acquisition of the American steelmaker.

Nippon Makes Desperate Attempts to Win Approval for U.S. Steel Deal

According to the Washington Post, Nippon proposed a 10-year commitment not to cut production capacity at U.S. Steel’s domestic factories unless a Treasury-led panel approves it. The move comes as Nippon is making final attempts to persuade the Biden administration to approve its $14.1 billion acquisition of U.S. Steel.

The White House has received a report from the Committee on Foreign Investment in the United States (CFIUS), with President Biden having time until January 7, 2025, to approve or block the deal. Nippon Steel’s proposed acquisition of U.S. Steel, which was first announced in December 2023, was highlighted as a major issue in the U.S. presidential elections, given the strong opposition by the United Steelworkers union.

There has been pressure on the White House to block the deal and ensure that the American steel giant is domestically owned and operated, thus protecting jobs. Last week, Nippon Steel postponed the closing date of the acquisition of U.S. Steel to Q1 2025 from the previous expectation of completion in the third or fourth quarter of 2024, as it awaits President Biden’s decision.

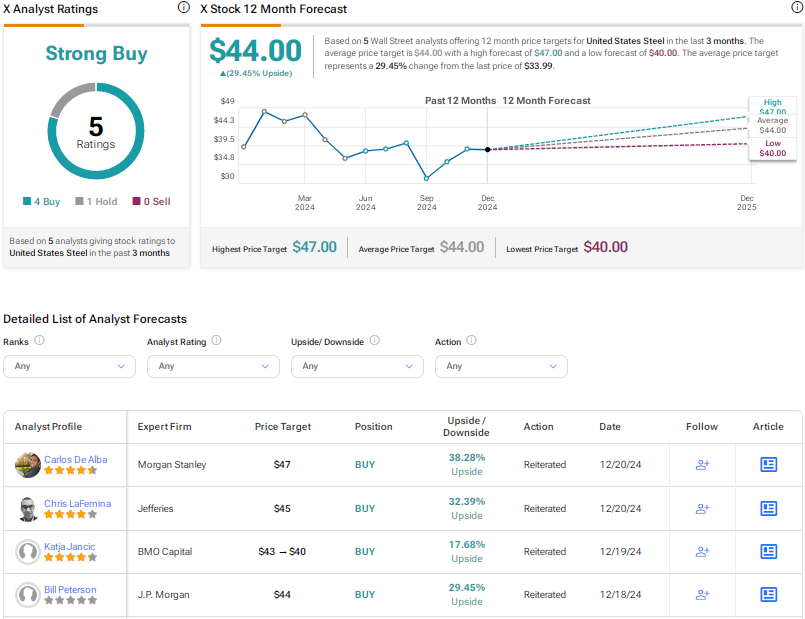

Is US Steel Stock a Buy, Sell, or Hold?

Despite the uncertainty surrounding the proposed acquisition and Q4 EBITDA guidance cut on weak demand in Europe, Wall Street has a Strong Buy consensus rating on U.S. Steel stock based on four Buys versus one Hold recommendation. The average X stock price target of $44 implies 29.5% upside potential. Shares have declined over 29% in the past year.