At a recent special meeting, U.S. Steel (NYSE:X) shareholders voted overwhelmingly in favor of merging with Nippon Steel (OTC:NSTIF). In fact, over 98% of the votes cast supported the proposal. This turnout represented about 71% of all outstanding shares of U. S. Steel. David B. Burritt, President and CEO of U.S. Steel, was happy with the outcome and believes that combining the strengths of both steelmakers will establish a global leader.

This merger is seen as a response to international competition, notably from China. Burritt pointed out that the move would strengthen U.S. Steel’s capabilities by enabling it to deliver innovative and environmentally friendly steel solutions worldwide while upholding commitments to its employees and continuing investments in Pennsylvania.

Is U.S. Steel a Buy or a Sell?

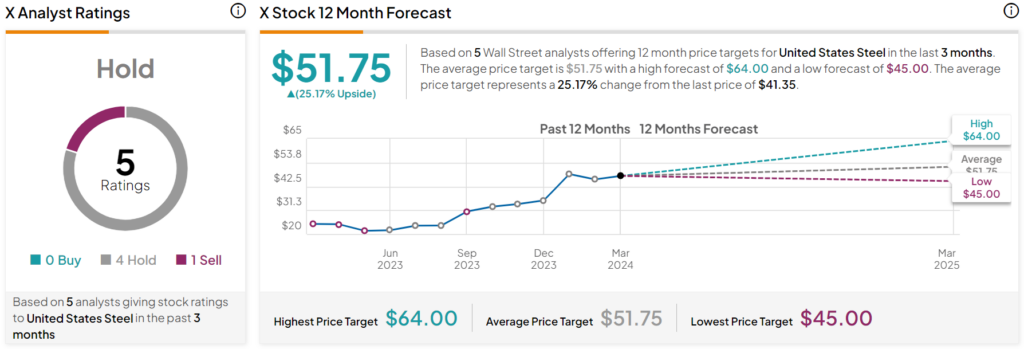

Turning to Wall Street, analysts have a Hold consensus rating on U.S. Steel stock based on four Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 58% rally in its share price over the past year, the average X price target of $51.75 per share implies 25.17% upside potential.