U.S. retail giants from Apple Inc. (AAPL) and Amazon.com Inc. (AMZN) to Target Corp. (TGT) are temporarily closing some of their stores and curtailing operations amid the violent nationwide protests following last week’s death of George Floyd.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Demonstrations in dozens of cities across the U.S., including New York and Chicago, have since turned violent leading in some places to looting and damage to a number of retail stores.

Apple, which had just reopened about half of its U.S. stores after the coronavirus related shutdowns, said it has temporarily closed many of its stores to protect the safety of employees and customers. Target announced the temporary closure of 175 of its stores across the country, including 32 in Minneapolis. Amazon said it is scaling back deliveries in a number of cities including Chicago, Los Angeles and Portland.

“Minneapolis is grieving for a reason,” Apple CEO Tim Cook wrote in a Twitter post. “To paraphrase Dr. King, the negative peace which is the absence of tension is no substitute for the positive peace which is the presence of justice. Justice is how we heal.”

Apple shares have recovered all of this year’s losses after appreciating 42% since mid-March. The stock closed little changed on Friday trading at $317.94

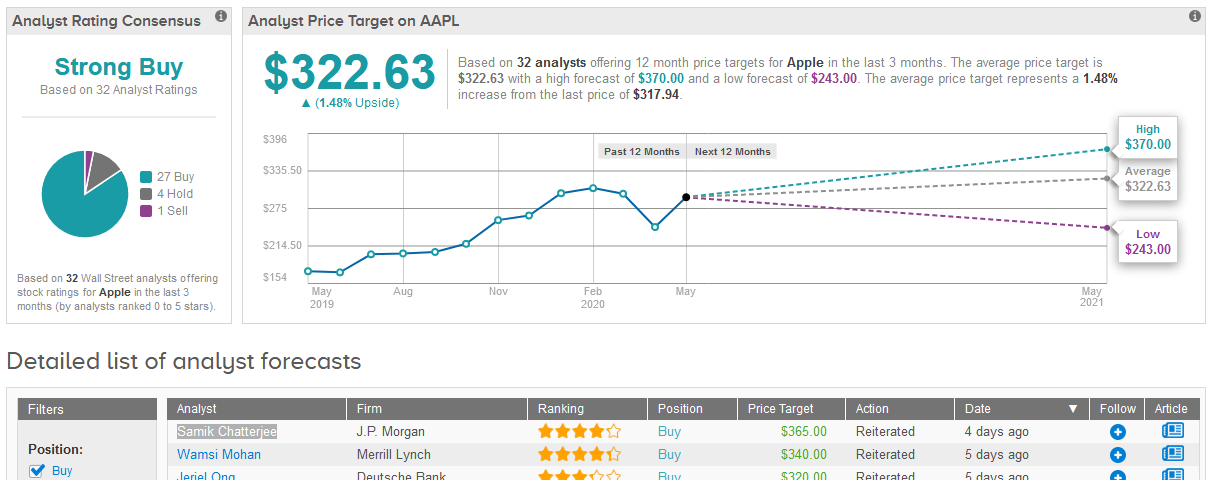

Four-star analyst Samik Chatterjee at J.P. Morgan sees more upside potential in the stock fueled by bullish prospects for the iPhone maker in India. Chatterjee last week bumped up the price target to $365 from $350 and maintained a Buy rating on the shares.

The analyst contends that the launch of the iPhone SE should help Apple build its position in emerging markets, particularly in India. The “attractive value proposition” with iPhone SE can change the landscape for Apple, which has struggled to build a material presence in India, he added.

“Our recent supply chain checks highlight key milestones relative to verification testing are on track for iPhone launches in September, in addition to no major component bottlenecks,” Chatterjee wrote in a note to investors. “Pre-order and shipping dates might differ modestly for certain models. Delay risks remain, but largely from incremental disruptions.”

Turning now to the rest of Wall Street, analysts mostly share Chatterjee’s bullish rating outlook on Apple’s stock. The Strong Buy consensus is backed up by 27 Buys with the rest split between 4 Holds and 1 Sell. However, following the recent rally, the $322.63 average price target indicates shares have limited upside potential in the coming year. (See Apple stock analysis on TipRanks).

Related News:

Logitech Shares Lifted In Pre-Market On Share Buyback Plan, 10% Dividend Boost

Apple Snaps Up AI Startup Inductiv, As Analysts Boost PTs On Store Reopenings

KKR Invests $1.5 Billion in Reliance’s Jio Platforms In Biggest Deal In Asia