The U.S. Federal Trade Commission (FTC) has officially approved oil major Chevron’s (CVX) $53 billion acquisition of rival Hess Corp. (HES).

But in a twist, the U.S. regulator has banned Hess Corp.’s current CEO John Hess from sitting on Chevron’s board of directors once the deal is completed. The FTC said it made the decision to ban Hess from Chevron’s board because it has evidence that Hess conspired with representatives of the OPEC cartel to keep prices for crude oil elevated.

In its ruling, the FTC said that allowing John Hess to sit on Chevron’s board would increase the likelihood that “Chevron would align its production with OPEC’s output decisions to maintain higher prices.” The regulator’s ruling is a win for Chevron but a blow to John Hess, who had hoped to have a hand in the combined companies. In a news release, Hess Corp. said that the FTC’s comments about John Hess and his dealings with OPEC are “without merit.”

The Guyana Dispute

Chevron and Hess Corp. said that they will not appoint John Hess to the board of the merged companies in order to facilitate the completion of the deal. Hess will now serve as an advisor to Chevron on government relations, said the companies. While the FTC’s clearance is an important step toward completing the merger, the deal still faces a hurdle over a dispute with Exxon Mobil (XOM) concerning Hess’ oil assets in Guyana.

Exxon Mobil is a partner with Hess in a Guyana oil project and is claiming a right of first refusal to any sale of Hess’s Guyana assets, which is one of the main attractions to Chevron. The matter is to be decided by a three judge arbitration panel in summer 2025. If the arbitration panel rules in Exxon’s favor, the Chevron-Hess deal is unlikely to close. Chevron and Hess have said they are confident that panel will rule in their favor.

Is CVX Stock a Buy?

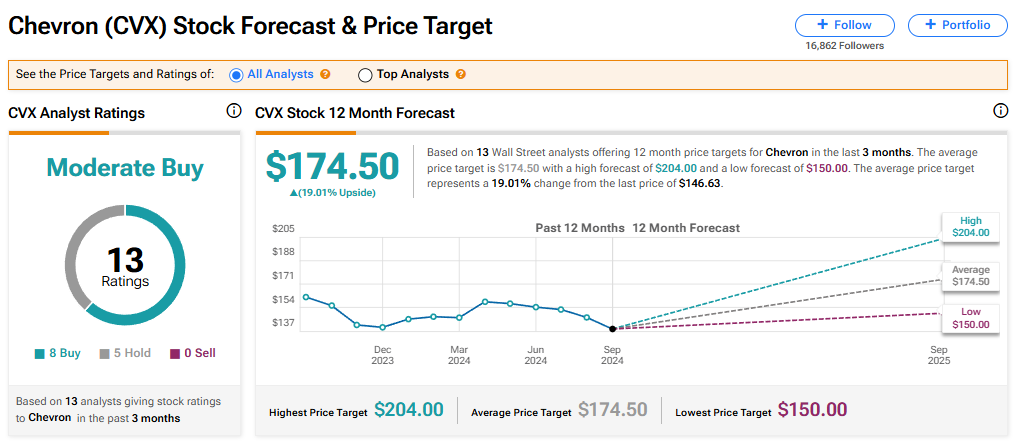

Chevron’s stock has a consensus Moderate Buy rating among 13 Wall Street analysts. The rating is based on eight Buy and five Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average price target on CVX stock of $174.50 implies 19.05% upside potential from current levels.